Russia Prolongs Oil Export Restrictions

On August 31, ICE Brent oil prices remained strong and showed an uptick the following morning. ICE Brent is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil purchases worldwide.

This market behavior was a response to an announcement from Russia about extending its export restrictions.

Russia's Deputy Prime Minister, Alexander Novak, announced that Russia will continue to limit its exports. This is important because Russia is a major global supplier of various resources, including oil. Limiting exports means they will send less oil to other countries.

When a major supplier like Russia decides to limit exports, it affects the supply chain globally. Other countries that depend on Russian oil will have to look elsewhere or pay higher prices, affecting everything from transportation costs to goods and services.

As the market saw the commitment to the export limitations, confidence grew, causing the oil prices to stay strong and increase. The announcement had a direct and immediate impact and will likely continue to shape the markets in the coming weeks.

The announcement is not just a one-off event. Its effects are expected to linger, continuing to influence oil prices and, by extension, the broader economy.

Russia's decision to extend its export restrictions aims to limit oil production and supply in the global market. This move was mainly prompted by Western sanctions and price controls following Russia's invasion of Ukraine.

Russia initially pledged to reduce its oil exports by 500,000 barrels per day but didn't fully execute this cut until June 2023. This action was influenced by Saudi Arabia, which had not only made its own unilateral output reduction of 1 million barrels per day but also extended it.

Reducing oil supply generally leads to an increase in oil prices, assuming demand remains relatively constant. Russia and Saudi Arabia would benefit from higher prices per barrel, increasing their oil-related revenues.

In response to Saudi Arabia's subsequent decision to reduce its cut to 300,000 barrels per day starting September 2023, Russia announced a similar scale-down of its export restrictions for the same month, setting the new cut at 300,000 barrels per day.

For September, the reduction was set at 300,000 barrels per day. Saudi Arabia is also expected to maintain its voluntary cut of around 1 million barrels per day into October due to ongoing concerns about market demand.

These export limitations have a multifaced impact. On the one hand, they have contributed to a rise in oil prices and improved the price differentiation for Russian oil grades, thereby increasing Russia's oil-related revenues.

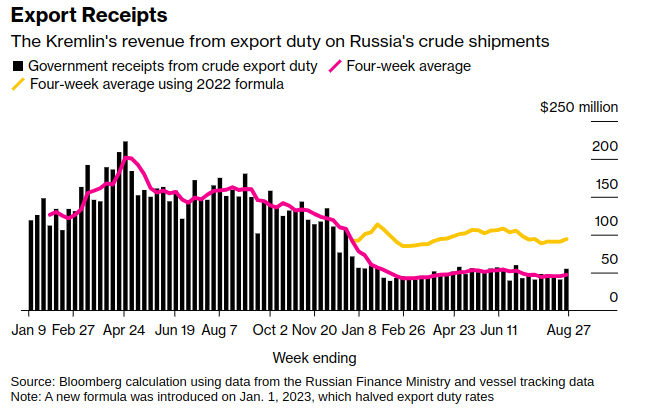

Cremlin Export Revenue

The Russian government made a lot more money from taxing oil exports recently. They pulled in $55 million in just 1 week. That's up $14 million or 35% from before. The average income over the last month was $47 million.

How it works?

Russia figures out how much to tax oil exports based on a set price, which is lower than the global market price. If the actual price is higher, they use that to calculate the tax. They set this base price for July and August at $25 per barrel, but it will drop to $20 a barrel starting this month (September).

However, the curbs have decreased crude oil availability for Russia's domestic refineries. That resulted in fewer exports of refined products and higher domestic prices for fuels.

Russia voluntarily reduced its oil exports to approximately 500,000 barrels per day in August, followed by a lesser cut of 300,000 barrels per day for September. Concurrently, Saudi Arabia is anticipated to continue its own voluntary production cut of about 1 million barrels per day into October, mainly due to persisting worries about global oil demand.

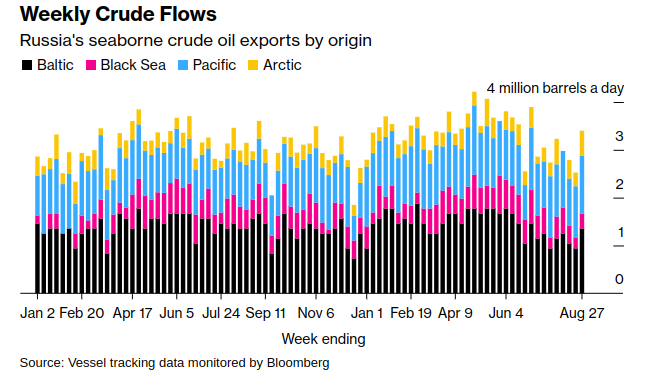

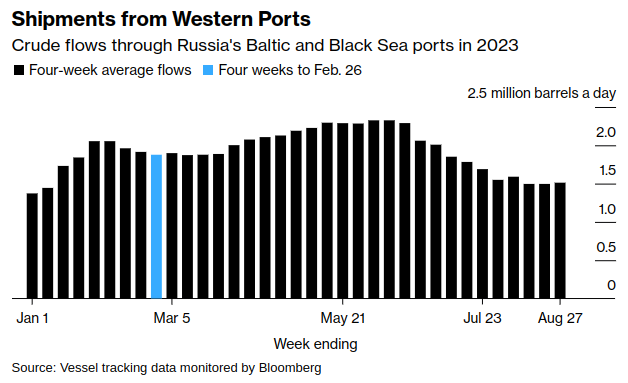

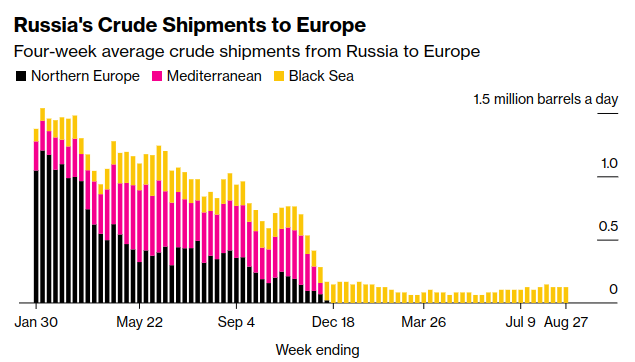

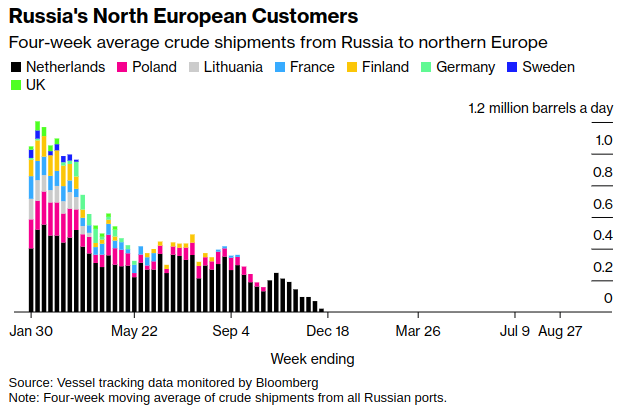

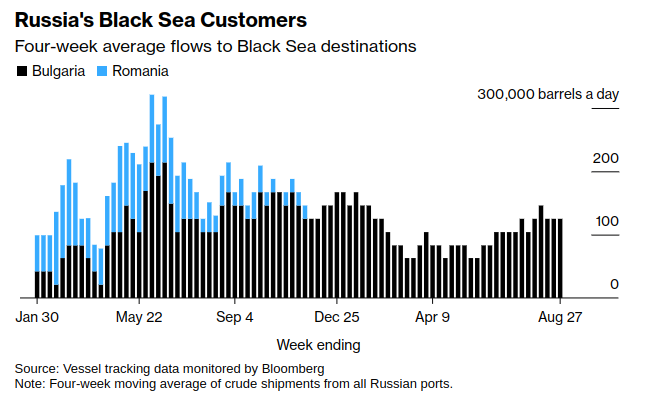

No crude oil from Russia was exported to Northern Europe in the four weeks leading up to August 27th.

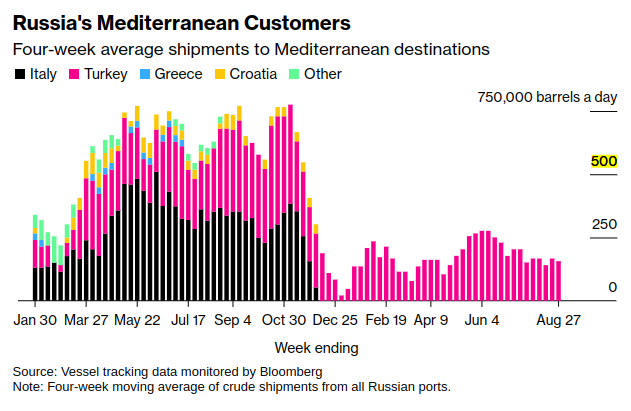

Russia's exports to Turkey, its only remaining Mediterranean customer, decreased to around 156,000 barrels per day in the four weeks leading up to August 27th. They had previously peaked at 425,000 barrels per day in October.

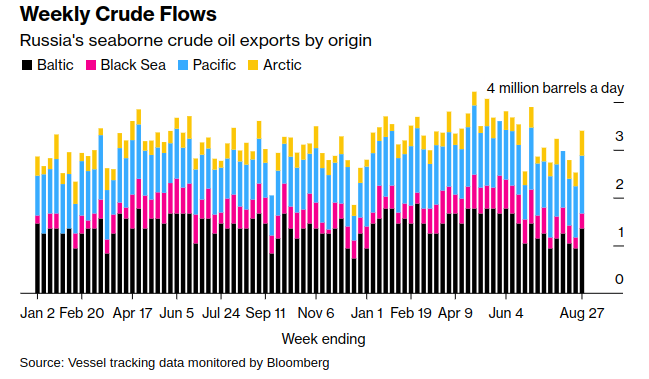

In the seven days leading up to August 27, Russian crude oil's total daily export rate was 3.4 million barrels. This represents a significant increase from the previous week, during which Russia exported crude oil at a rate of 2.53 million barrels per day.

The additional exports were not concentrated in a single region but were instead distributed across multiple areas. Nearly 50% of crude oil exports increased from the Baltic region. This could mean that this region has ramped up its export capacity or increased demand for crude oil from the Baltic.

(The data excludes certain Kazakhstani crude oil blends exported from specific Russian ports)

Vessel-tracking data is cross-checked with reports from port agents and other information providers, like Kpler and Vortexa Ltd, to verify ship movements and flows.

China

In its third quota release of the year, China collected an export quota of around 12 million tonnes for clean refined products, which includes gasoline, jet fuel, and diesel.

China has set limits or quotas on how many refined oil products (like gasoline, jet fuel, and diesel) can be exported. They do this periodically; the recent announcement is the third quota release for this year.

So, for this specific period, China has said that up to 12 million tonnes of these clean, refined products can be exported. Adding 12 million tonnes to the quotas released earlier in the year totals around 40 million tonnes of all 2023.

Last year, in 2022, the total quota for the whole year was around 37.5 million tonnes, so this year's total is already higher and we haven't even reached the end of the year.

Why are they doing this?

China has more of these products than it currently needs. This oversupply is due to 2 main factors.

- Slower-than-expected demand within China for these products

- Increased production capacity (they can make more than before)

By allowing more of these products to be exported, hence the higher quota, China is trying to get rid of the extra supply.

So, China has too many redefined oil products and they're allowed to export more to get rid of the surplus. This recent quota is part of their strategy to balance their domestic market.

Are you a premium member of the newsletter but still didn't join Discord?

(Also article does not end here)

Join Discord to get the full value out of the newsletter. There's no extra cost associated with Discord. Yes, options data, such as dark pools, unusual flow, etc., are also included.

U.S. Natural Gas Inventory Hits Seasonal Highs

The Energy Information Administration (EIA) is a U.S. agency that tracks energy data, including how much natural gas the country has stored.

Over the last week, the amount of stored natural gas in the U.S. increased by 32 billion cubic feet, making the stored amount 3115 billion cubic feet as of August 25th.

Compared to last year, the U.S. has about 484 billion cubic feet more natural gas in storage.

When looking at a 5-year average for this specific time of the season, the U.S. has about 249 billion cubic feet more natural gas stored than usual.