🔥 Ride into the Year-End

Today is the big day, boys. Yes, the big day! Let's forget about economics for one moment because Spotify is bussin with its much-awaited annual "Wrapped" feature. Yes, it's that time of the year when we all discover the artists who provided the soundtrack to our lives over the past 12 months.

Let's face it, boys (and perhaps a few autistic femcels reading), our playlist hasn't changed much since last year. Is this deja vu, quirky nostalgia, or are we just getting old?

As we are all getting hit by Taylor Swift, Ariana Grande, Dua Lipa & Tate McRae (The new bitch on the block), we have secretly listened to them as our top tracks 😏

Well, shit, I'm writing my first article on dextroamphetamine, and my train of thought is taking over. Let me try to get back on topic.

This article contains more than 300 words.

- Macroeconomics

- History

- The Year-to-end rally? Or not?

- Options & market impact

- Dealer flow

- Oil

- Bitcoin

There's a different kind of "bussing" unfolding in the world of central banking today.

Of course, we are talking about interest rates, something we haven't seen since Fed Volcker made headlines.

Dive into the lizard gang of the Federation of Retarded Reptilians, and you'll find different opinions floating around. Raphael Bostic thinks inflation is on a downward path. On the other hand, Thomas Barkin and Loretta Mester are playing it safe and aren't quite ready to "shut the door" on future rate hikes.

The markets reacted positively to some dovish comments from Chris Waller. Bond prices went up, meaning yields went down. This inverse relationship is something I've explained many times in my previous newsletters and medium articles, which you can find back.

Now, on the other end of the world, we have Europe. Both Spain and Germany reported decreases in their inflation rates. This has led to some optimism in the market, and people are watching closely to see if France and Italy will report similar trends.

Plot Twist: here it is. Despite lower inflation and higher growth, the OECD says Europe shouldn't expect rate cuts until 2025. This cautious stance somewhat aligns with our own forecasts, including a potential mid-next-year rate cut by the Fed.

OECD? Yeah, I wrote a medium article about it. You read It would be best if you them all here https://romanornr.medium.com/

History class - Roman Empire

There's a historical parallel here, too. Roman emperors like Augustus and Tiberius dealt with inflation and money supply, linking it to today's economic situations. It's like history repeating itself.

You are forgiven for the few unfamiliar with this part of history. It's interesting anyway. If you paid some attention in school, and hopefully still remember Roman emperors like August and Tiberius ruled during the early Roman Empire, a period when Rome had a big influence over the Mediterranean economy.

Trust me, keep reading, it won't be boring. IF YOU SKIM, YOUR ENTIRE PORTFOLIO WILL BE LIQUIDATED BEFORE THE END OF THE YEAR

Inflation and Money Supply

So, dealing with inflation and money supply. August is known for his efforts to stabilize Rome's economy after years of civil war. One of his strategies was to increase the money supply by introducing new coins and bringing in wealth from conquered territories like Egypt. That influx of money and resources helped stabilize and grow the Roman economy, but it also had the side effect of causing inflation. The broad rise in price due to increased money supply. Sounds familiar.

Tiberius took a different approach. Concerned about the inflationary pressure and economic stability, Tiberius tried to control the money supply and stabilize the economy. He was known for hoarding a lot of Rome's wealth. Some argue that led to a shortage of circulating currency. Later, he tried to "ease" this shortage by providing interest-free loans to certain groups, an early form of "Quantitative Easing."

In my past, I went to a Christian elementary school and middle school. The elementary school because it was close to home, and I went to the Christian middle school, which I chose myself because instead of 60 minutes in class, that school chose 80 minutes in class.

This meant fewer books to carry, and 80 minutes would be more sufficient to get into a "flow state". Well, I didn't know what a flow state was, but when you had math class, nobody wanted to start, but when focussed, nobody wanted to put their pencil down when the teacher asked, like an unstoppable train he described.

Anyways, part of this in Elementry school was the teaching reading the bible to use every morning for 15-30 minutes. In Middle school, 80 minutes per week.

So, I remember this story in the bible: Jesus once visited the Temple in Jerusalem and was upset to find money changers and merchants conducting business there. He overturned/flipped/threw their tables and accused them of turning a sacred space into a place of thievery. This event is important to some Christians because it demonstrates Jesus' disapproval of commercializing and profiteering in a holy place.

In the Temple, there were money changers who exchanged Roman coins for currency that could be used to buy offerings and pay the Temple tax. The Roman coins were considered idolatrous because they bore the emperor's image.

Although this service was necessary for the temple's functioning, the money changers were accused of charging high rates, which led to the exploitation of those who came to worship.

Today

Today, central banks and governments face similar challenges in managing the money supply, controlling inflation, and stimulating economic growth.

Policies like adjusting interest rates, quantitative easing (injecting money into the economy by buying government securities), and fiscal measures (like stimulus packages) are the "modern tools".

Historical parallel

They say, "History never repeats itself, but it does often rhyme," and there is a historical parallel in these economic challenges and responses. Like August and Tiberius, modern policymakers must balance stimulating growth and controlling inflation. These methods may have involved some challenges, but they are still similar.

In response to economic crises like the 2008 financial crisis or the COVID-19 pandemic, many countries adopted policies to increase the money supply and lower interest rates, hoping to stimulate economic activity. However, those actions also come with the risk of increased inflation, mirroring the challenges faced by Roman emperors.

Similar to how Jesus criticized the money changers for placing profit over the spiritual significance of the temple, there is a concern that current monetary policies may prioritize financial mechanisms and market expansion while potentially overlooking the larger socio-economic well-being and moral considerations.

God, I'm stim trippin balls rn

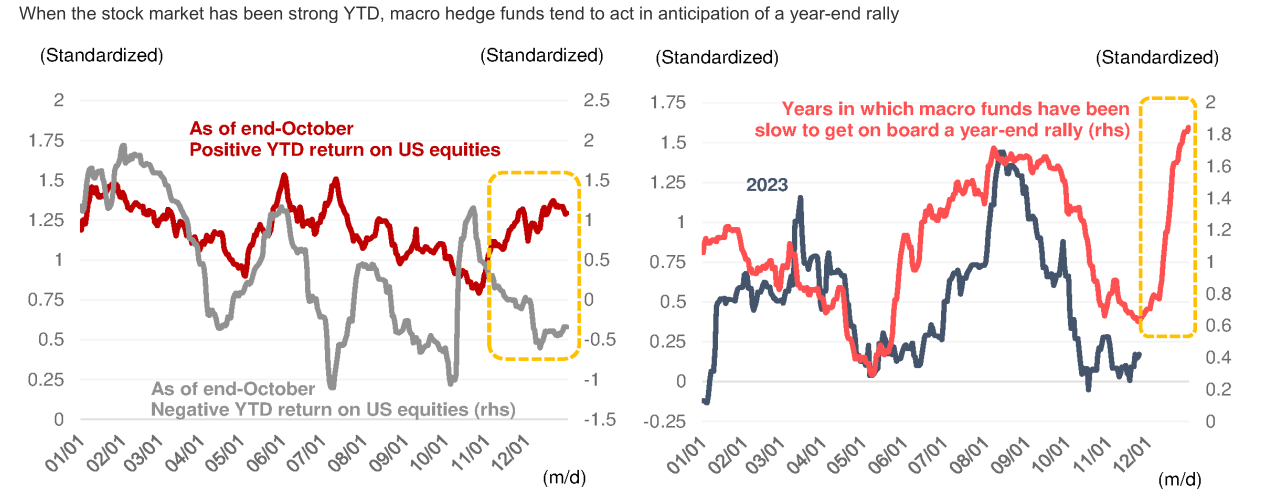

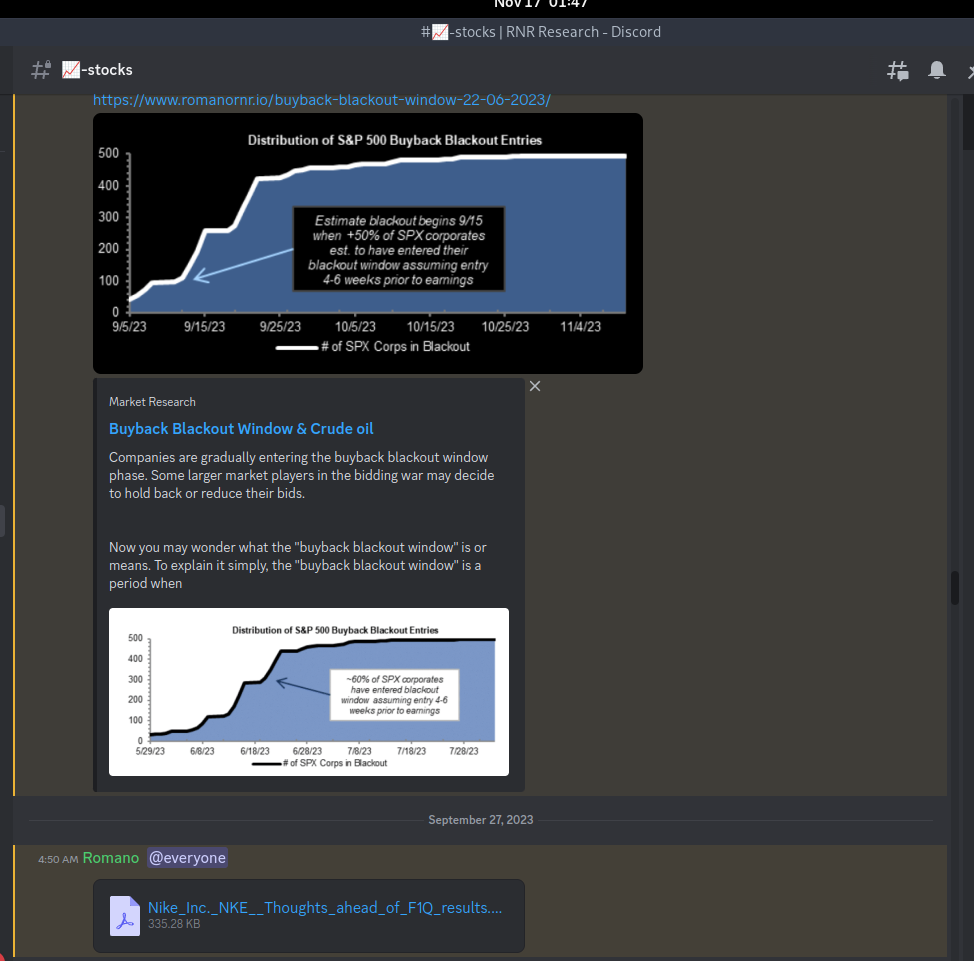

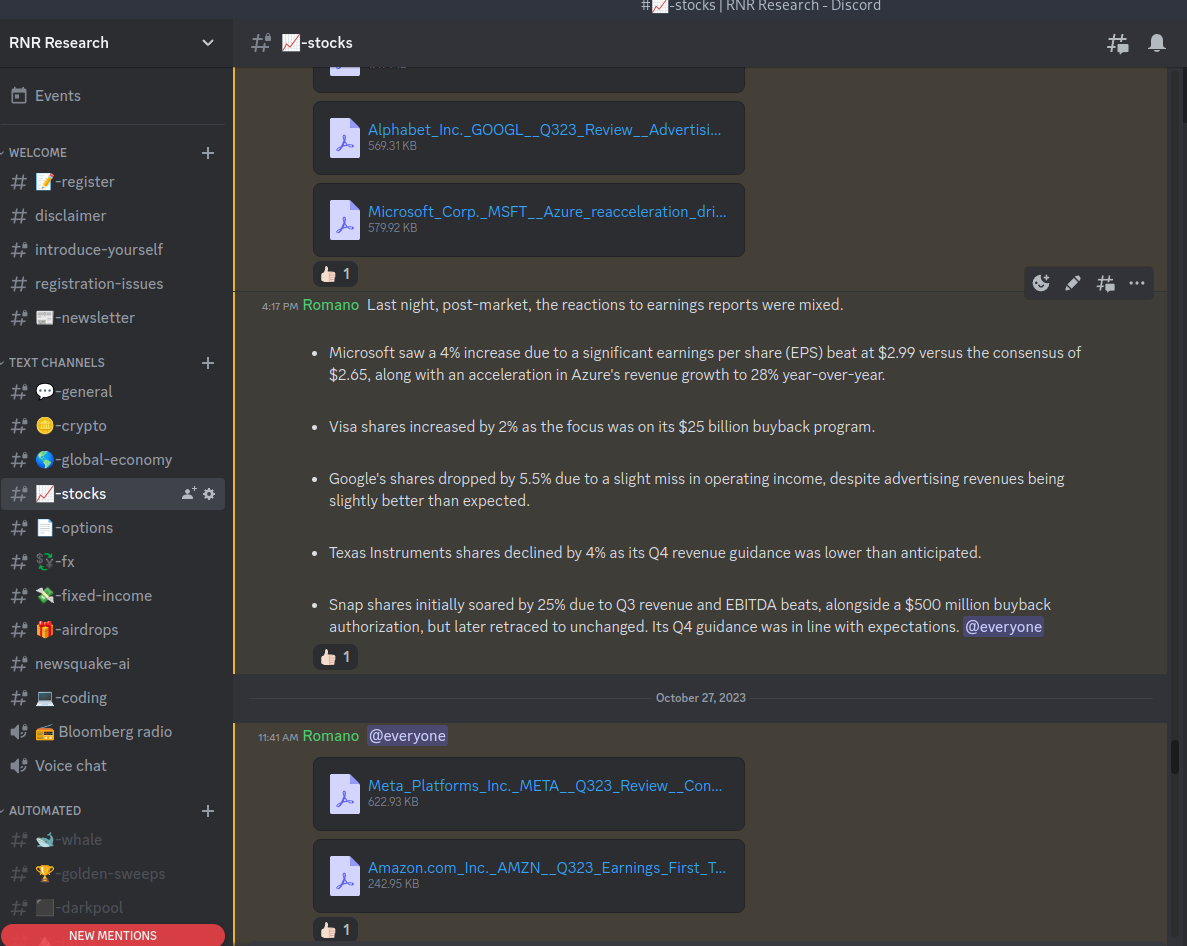

Macro Hedge Funds might be betting big as the year wraps up

2-3% dip Usually, when the stock market has had a good run throughout the year, macro hedge funds start to increase their presence in the equity market. They do this in anticipation of the "year-to-end rally", where prices go up before the fireworks on New Year's eve.

This year, the stock market indexes have shown massive returns, especially the magnificent 7 (Google, Nvidia, Microsoft, Meta, Tesla, Apple, Amazon), but it looks like these funds aren't as willing to up their game this time. They've only modestly increased their stakes in the market.

Don't be fooled, this isn't them being "bearish'. It's more like they're a bit late to the party. Heading into the final stretch of 2023, they are expected to increase their stock investments.

But look, these year-end rallies in the stock market aren't just happy coincidences, simple anomalies, or some astrology. They're closely tied to the ebb and flow of money moving and out of equity hedge funds.

What's behind the year-to-end rally?

The year-to-end rally in the stock market isn't just some random event or a simple anomaly. There are some patterns.

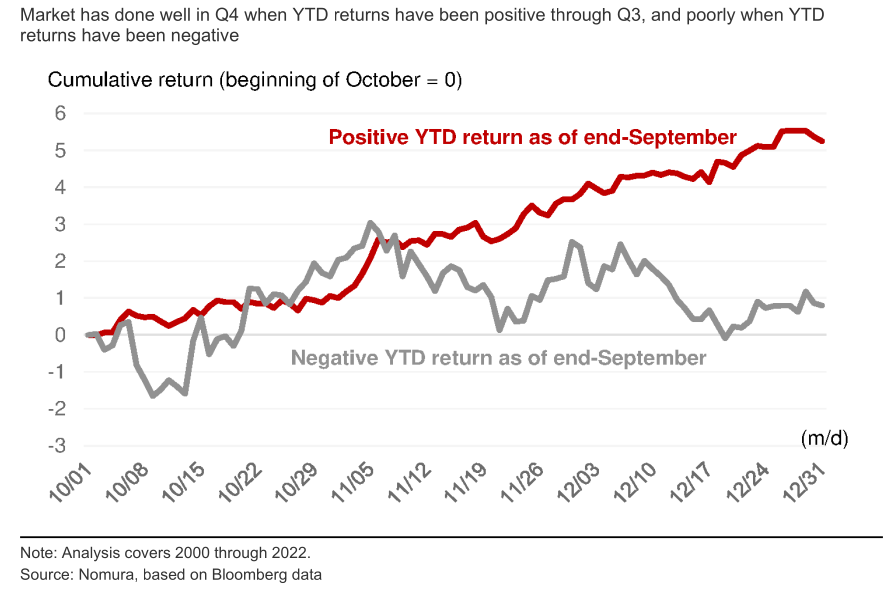

It's a lot about "momentum", if the stock market has been ripping from January through September (Q1 - Q3), there's a good chance the the fourth quarter (Q4) will also have a high chance of strong performance and reflexivity.

On the other side, if the market has been down in the first three quarters, Q4 tends to be weak. Momentum plays a large role.

This momentum effect is partly driven by how money flows in and out of hedge funds in Q4. For long-biased equity hedge funds, which lean more towards buying stocks, their performance is typically in sync with the market. I'm not sure what to call this: hedge funds without hedging! Just like crypto hedge funds!!!!

Anyways, when these funds do well up to Q3, they usually attract more investments (inflows) in Q4, but if they lag behind, they often see withdrawals (outflows).

The stock market's overall performance in Q4 seems to split into 2 paths based on these inflows and outflows in hedge funds.

Macro hedge funds are no strangers to these patterns. They're paying attention to these trends, especially the relationship between hedge fund flows and the likelihood of a year-to-end rally.

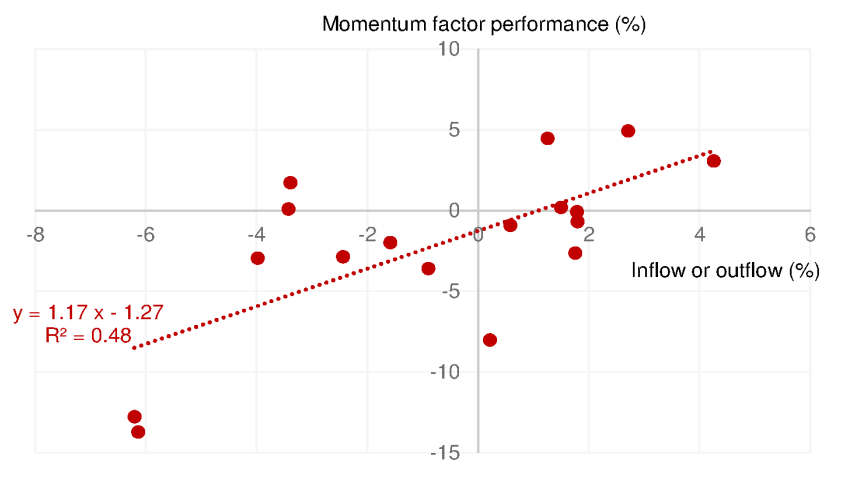

Expecting changes in momentum factor performance until mid-December

Stock performance is influenced by the momentum factor which is important for stocks that have been trending either upwards or downwards. This month, the momentum factor has decreased by about 4%. The momentum factor is important because it shows that stocks that have been doing well are likely to continue to do so, while those that have been underperforming are likely to continue to do poorly.

Looking at historical patterns, there could be an additional 2-3% dip in the momentum factor before we reach mid-December.

Market-neutral funds aim to avoid being affected by overall market movements and are expected to see outflows in Q4, like 5% of their total assets under management. Those outflows can have a substantial impact on the momentum factor. Market-neutral funds usually balance their investments between long (buying) and short (selling) positions, and these outflows could lead to selling pressure, impacting momentum.

The recent shift in equity performance is not solely due to the basics but is also influenced by broader economic challenges such as falling interest rates and a weak dollar. These challenges are changing the investment game and, coupled with the outflow from market-neutral funds, are putting pressure on the momentum factor.

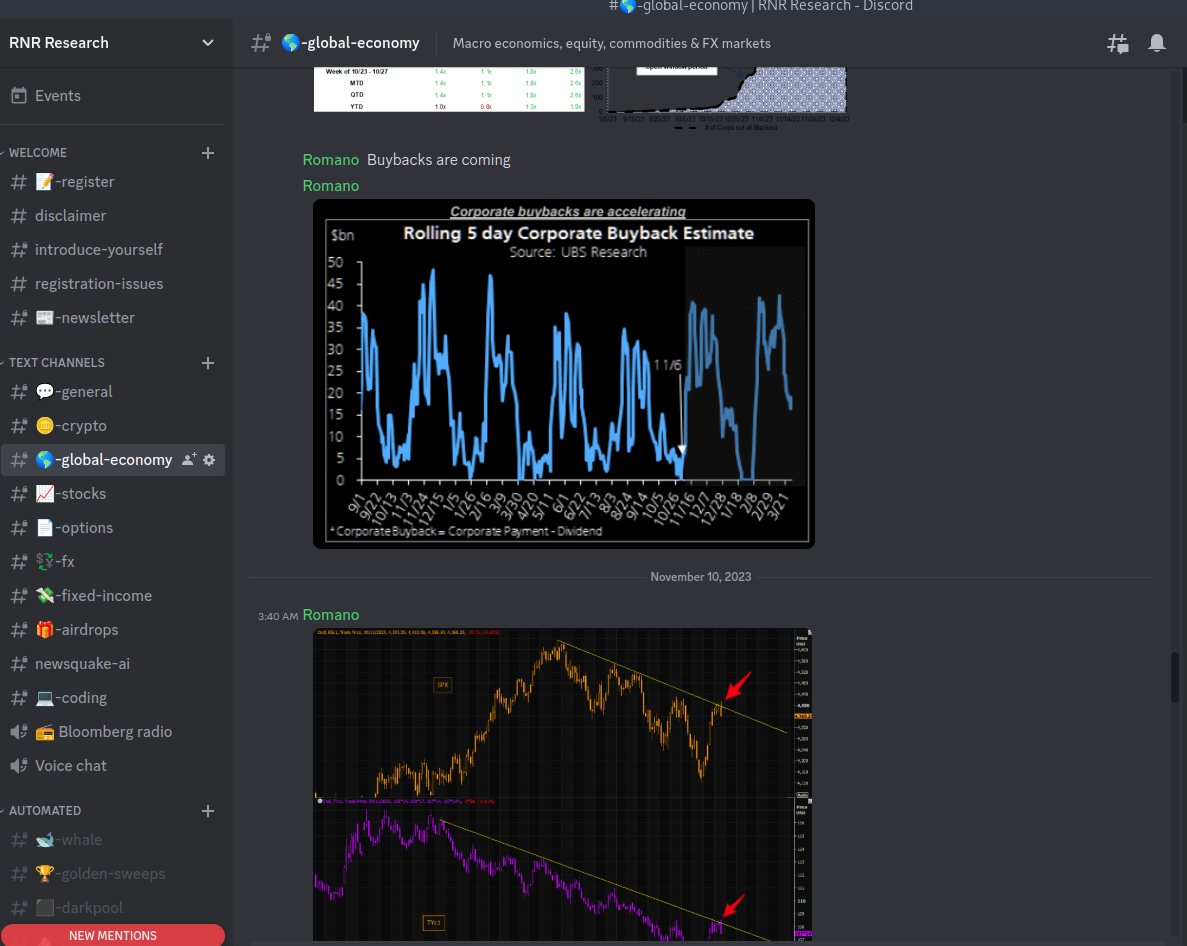

Macro hedge funds are paying attention to this situation. The outflow of assets from market-neutral funds could change the momentum factor, which could affect their investment strategies. As they monitor these trends, they may take on more risk as the year ends, particularly in light of other market dynamics, such as dealers' long gamma position.

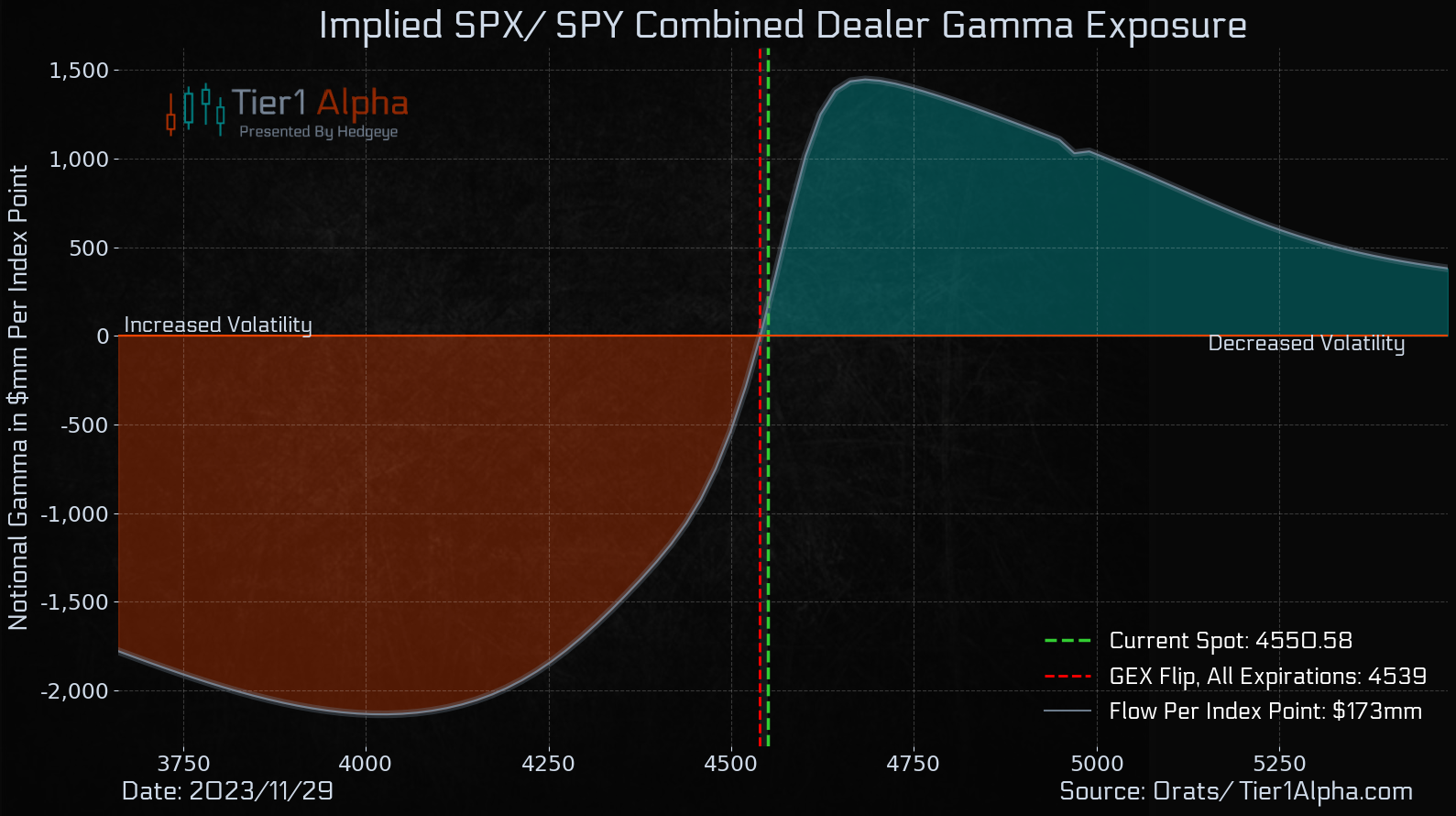

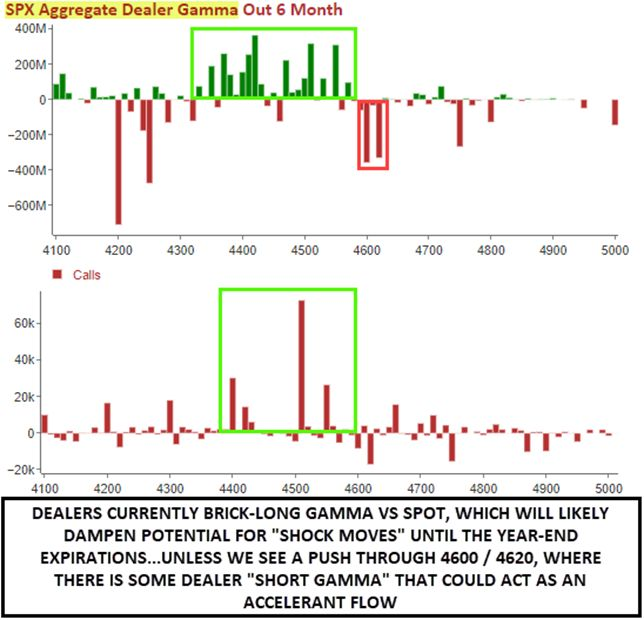

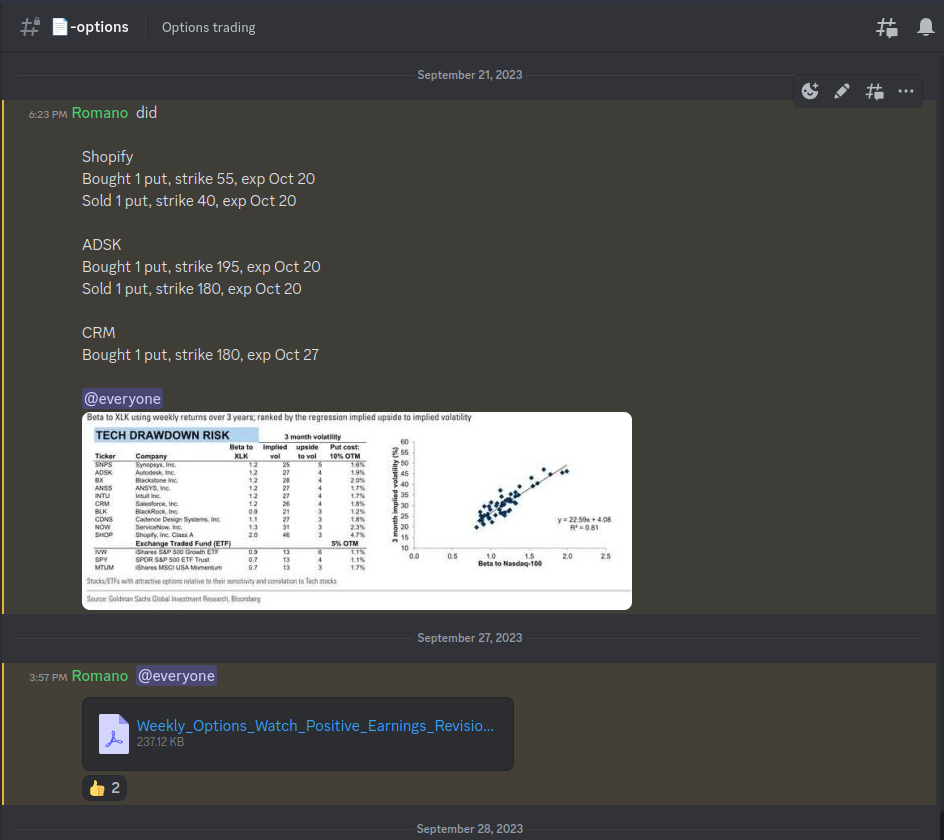

Here's a more up-to-date Gamma exposure implied SPX/SPY combined dealer exposure

,

Flows into or out of market-neutral funds in Q4 vs the performance of the TOPIX

500 momentum factor

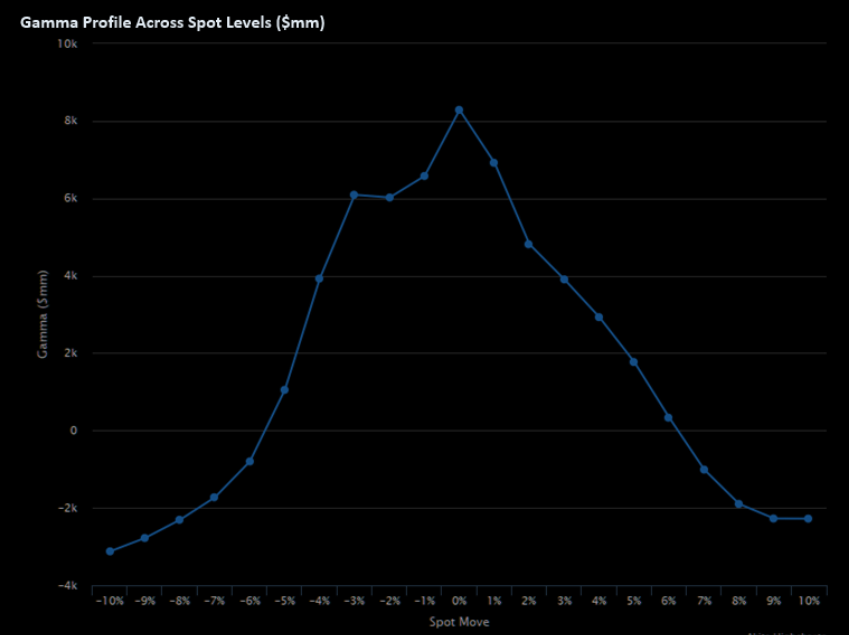

Dealers and Volatility, Calm before the storm in options?

In options, dealers (market makers, or however you want to call them to facilitate trades) often find themselves in a long gamma position. It happens because they're consistently VRP (Volatility Risk Premium) harvesting. They sell options to earn a premium, betting the market will be less volatile and theta decay will do the rest.

However, this time, dealers unintentionally got long vega. I'm not going over what vega means, but you can read my options series here.

If you're too lazy to look into Vega, here's a video

“Vega” is the option contract Greek that measures the exposure of the contract to changes in implied volatility.

But, yeah, I assume nobody will click on my article, so here goes. In simpler terms, if the market volatility increases, the option's value might also increase, but there's a catch. Right now, the market is unusually calm, with realized volatility dropping to the lowest levels in over 2 years.

This low volatility environment creates a problem for dealers; they're stuck with positions that benefit from high volatility, but the market is extremely calm.

So this unusual phase of very low volatility, with the 10-day realized volatility of the SPX500 (SPX 10d rVol) dropping to 4.6, the lowest it's been in over two years.

In response to this mismatch and having to manage their options Greeks, dealers are actively participating in "Short Vol," selling options that would gain value if volatility rises. They do this as a hedge to protect their PNL in their Long Vega positions.

The more volatility drops, the more they need to sell options to protect themselves.

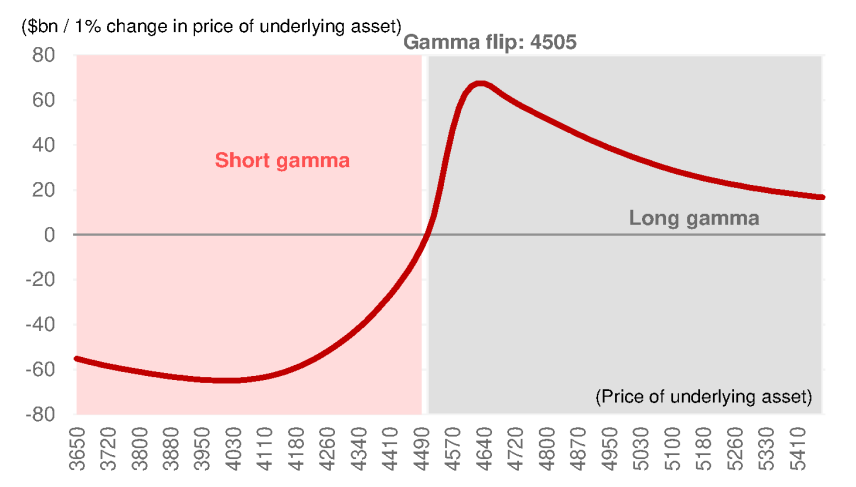

The top section displays bars indicating positive or negative dealer gamma positions. Gamma is a measure of an option's delta change relative to the S&P 500 index.

A positive gamma position means the dealer's position becomes more favorable as the SPX moves, while a negative gamma position means the opposite.

The lower section shows call option volumes for each strike price. Taller bars indicate higher call volumes at certain strikes (in red).

Dealers currently hold a significant amount of long gamma positions compared to the SPX spot price. This could stabilize the market, reducing potential "shocks" as the year ends unless the SPX500 pushes through 4600/4620.

At those levels, dealers will be forced to buy the underlying (you get) to hedge their deltas because as the market moves higher, their delta becomes negative, and they have to force buy a lot due to the convexity of those options.

Before you get swept up in the buzz of a possible gamma squeeze, remember that SPX has been hovering in the 4520/4580 zone since mid-November. Dealers loaded with long gamma have been "drowning in Theta decay" for quite some time now. The choke is real.

So blabla, long gamma, long vega, VRP harvesting, etc.

This calm in the market has an effect, prompting "Target Volatility" or "Vol control strategy funds" that aim to maintain a consistent level of risk depending on volatility to crack it up a notch or 2.

They're moving money around. Over the past week, there's been a massive inflow poured into U.S. equities.

To put that into perspective, this buying activity is way up there, ranking at the 94 percentile of what we typically see over a one-week period. Just 2 days ago, there was an additional $7.3 billion influx.

If the market sees daily changes by 0.5% each day, another $21.3 billion will be pushed into the U.S. stock market next month. If the market remains stagnant, the figure could increase to $37.2 billion.

Anyways

Dealers are balls-deep in long gamma positions, some of the heftiest they've had since 2019 as Goldman Sachs points out. Note that gamma diminishes mainly on an upmove from here, but for now, dealers must buy downticks and sell upticks.

It's like they're the market's shock absorbers, keeping things from getting too wild. So Yolo into OTM call options is not the greatest idea anon. Buying naked puts is tricky, too.

Perhaps straddles, ratio put spreads, put ladders, put butterfly spreads, or dynamic delta hedging. I'm not sure if Tail-risk hedging is ideal. It depends on your exposure.

IF YOU MADE IT THIS FAR, YOU ARE PROBABLY A CERTIFIED AUTIST. THE ARTICLE DOES NOT END HERE

Become a Premium member. Premium newsletters & Discord community access

ALSO, THE ARTICLE DOES NOT END HERE

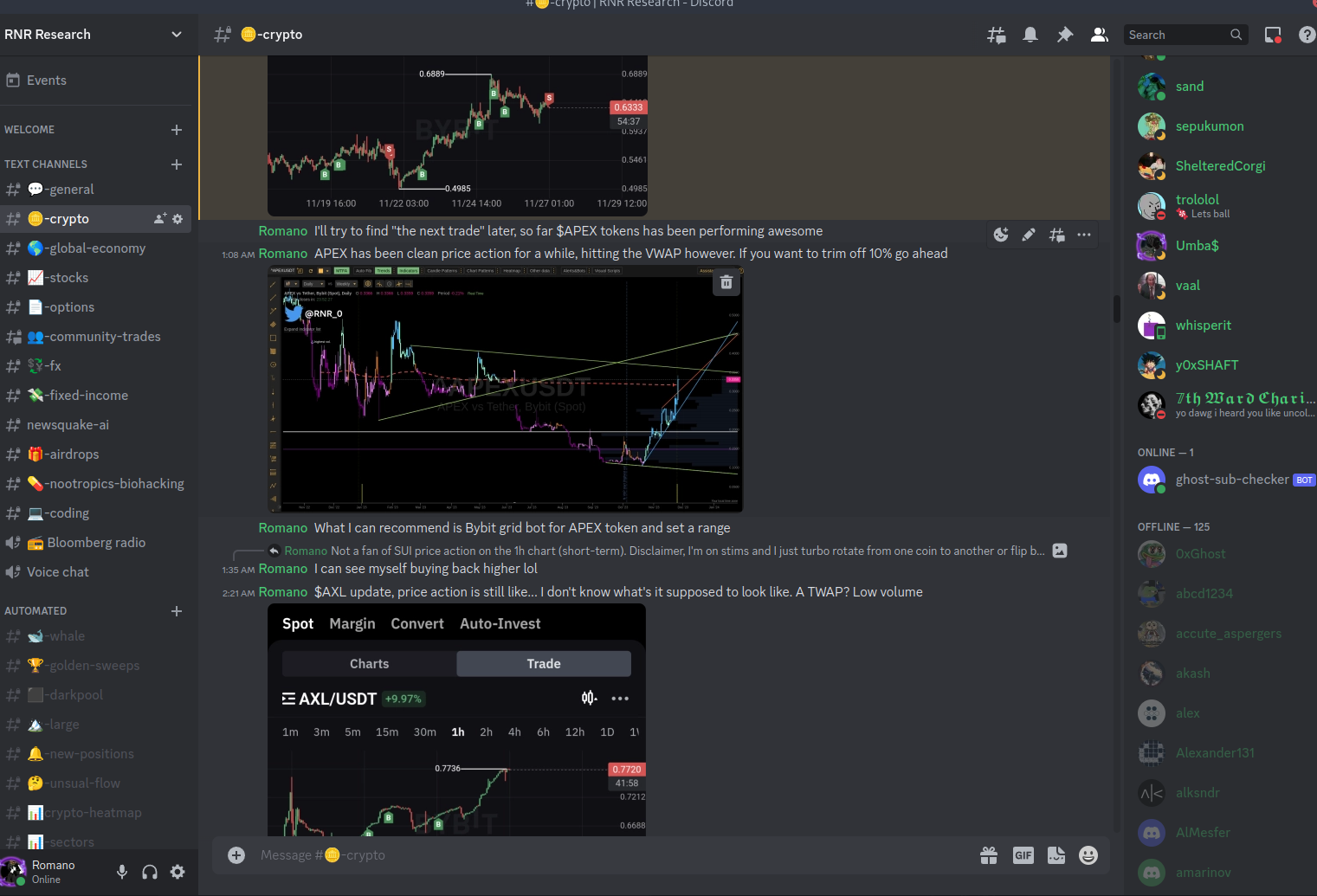

Join Discord to get the full value out of the newsletter. There's no extra cost associated with Discord. Yes, options data, such as dark pools, options gamma, unusual flow, etc., are also included. Also, educational content, reports, and direct questions to me, and often, I share my trades & thoughts in real-time as the market moves.

However, I want you to understand rather than copy a trade.

Become a premium member. Besides crypto, if you cashed out a lot or are planning to. I highly recommend "stocks" and "fixed-income" section for long-term plays and wealth building

The community has been growing since the Black Friday sale. A lot more activity, and my own activity in Discord has increased. Remember, the main purpose is real-time updates, research & bonding.

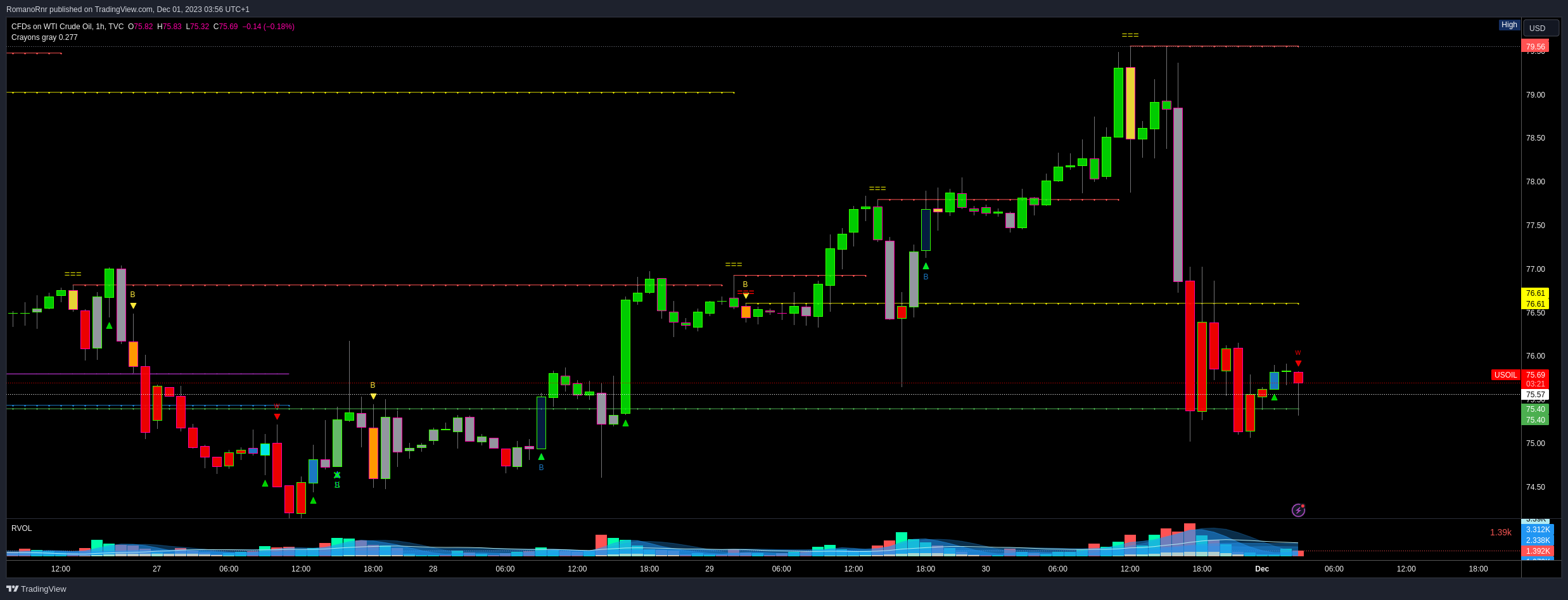

Sir, why is oil down today

Oil prices didn't jump up after OPEC+ announced they're cutting down oil production. So, they said they'll cut ~2 million barrels per day for the first quarter.

About 1.3 million barrels of this cut isn't new. Saudi Arabia and Russia were already cutting this much. Saudi Arabia cut 1 million barrels a day, and most people already expected that for early 2024. As for Russia, 300k barrels per day, there is some skepticism about whether they stick to it. Russia hasn't been great at sticking to commitments.

The last 500k barrels a day is unclear if this will mean less oil on the market. Some of it might be on paper, or they might be cutting quotas they weren't meeting anyway.

Why did oil prices not go up, especially with Brazil set to join OPEC+ in January 2024? Shows how OPEC's lack of transparency can sometimes backfire.

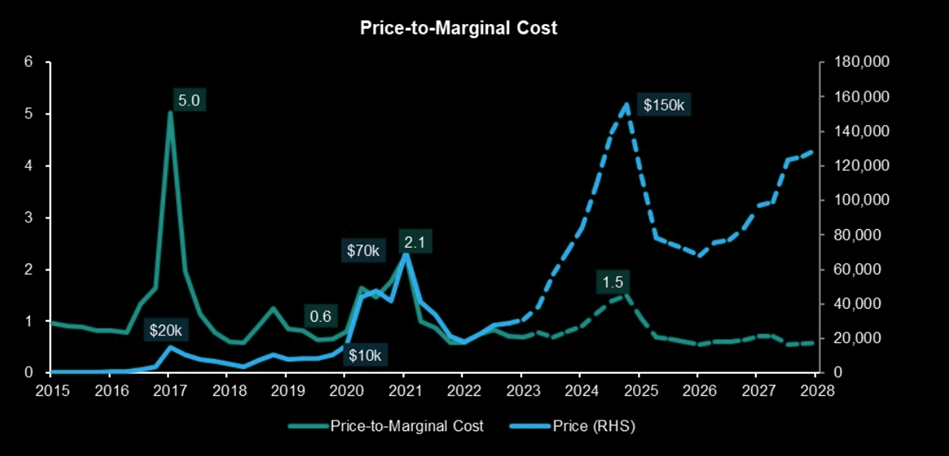

BTC price cycle trades at a multiple of the marginal cost of Bitcoin production

This graph breaks down Bitcoin price movements over time, compared to how much it actually costs to make/mine a BTC.

- Price-to-Marginal Cost: This shows how many times more expensive Bitcoin is compared to the cost of producing it

- In 2017, BTC's price was at an all-time high, costing 5x more than its production cost and a projection forecast peak in 2025.

- $20k in 2017 when the "Price-to-Marginal Cost" ratio spiked to 5.0, and a projected value of $150k when the ratio is expected to reach 1.5 by 2025.

So, this analysis is to make predictions about the future price movements of Bitcoin based on its production costs. It shows when there are times when BTC trades at a significant multiple above its marginal cost of production, potentially a sign of overvaluation, followed by corrections.

- So, BTC to ~$150k before the end of 2025?

Then turbo nuke down to $60k previous high. Okay, let's not talk about that. But most likely, people will overleverage, buy altcoins, and keep buying and pushing up their average price only to be down on average. I assume the crowd will buy at psychological levels; that's where the "Chads" buy.

However, Chad may make a wild amount of money. Over the span of 10 years in crypto, I've learned.

You either die as a Chad or live long enough to see yourself become a delta-neutral virgin.

Also, if you are a premium member, join Discord for full benefits.

Anyway, this article has been way too positive. Let's introduce some negativity too.

Anyways, make sure to cash some out next cycle; buying a house is basically unaffordable right now.

ApeX DEX

ByBit has made KYC mandatory as many other exchanges. Why not try out ApeX DEX? You can use your wallet or social account to use the DeX. No gas fees are required for trading & the fast trading experience is like a CEX.

You don't even need metamask. Using social logins like Facebook, Discord, Gmail is an alternative option. That way, you can access ApeX anywhere.

Consider ApeX DEX

By the way, ApeX added a lot more altcoin futures such as Celestia $TIA

Instructions:

https://twitter.com/RNR_0/status/1652360705331347461

For a lifetime fee discount, check the link.

Signup: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

Ref code: 46

Social logins is optional to trade anywhere without the need to be at your desk etc.