"G7 of the East" - Changing the Global Monetary System

Zoltan Pozsar is a macroeconomist and investment strategist. He's a recognized expert on global macroeconomic and financial market trends and has written extensively on global imbalances, U.S. monetary policy, and the global economy. He's the Director of Credit Strategy at Credit Suisse and a Visiting Fellow at the Peterson Institute for International Economics.

Note: Use the player to listen to this article instead of reading

He recently released his report: Dusk For The Petrodollar, Dawn For The Petroyuan, And The Coming Commodity Rehypothecation.

In his previous report, Zoltan Pozsar details how Putin may cause a financial crisis in the West by requiring that Russian oil exporters be paid in gold instead of dollars, linking oil prices to gold, and introducing the Petrogold currency.

This would lead to a banking crisis as most western banks would find themselves with a synthetic gold short. This means the banks would find themselves in an “asymmetric liquidity position” due to long OTC derivative receivables hedged with futures. He warns that this could cause an unexpected mobilization of reserves and an expansion in balance sheets and risk-weighted assets, which would be unwelcome at the year-end turn.

"Banks active in the paper gold market would face a liquidity shortfall, as all banks active in commodities tend to be long OTC derivative receivables hedged with futures (an asymmetric liquidity position). That’s a risk we don’t think enough about and a risk that could complicate the coming year-end turn, as a sharp move in gold prices could force an unexpected mobilization of reserves (from the o/n RRP facility to banks) and expansions in balance sheets (SLR) and risk-weighted assets. That’s the last thing we need around year-end."

This statement refers to the risk posed to banks who trade in paper gold by potentially establishing a Petrogold currency. If this were to go ahead, banks active in the paper gold market would face a liquidity shortfall because they tend to be long OTC derivative receivables that have been hedged with futures, creating an asymmetric liquidity position.

This means that if gold prices suddenly increased, there could be an unexpected mobilization of reserves from the overnight repurchase agreement facility and an expansion of balance sheets and risk-weighted assets.

This could have severe repercussions for financial institutions as it could drastically alter their balance sheets and put them in a vulnerable position.

What is the overnight repurchase agreement facility?

An overnight repurchase agreement facility is a mechanism used by the Federal Reserve or other central banks to purchase securities from banks and other private institutions to provide them with short-term liquidity.

This facility provides a quick and easy way to access cash in times of need and can also be used as a form of monetary policy implementation. Banks participating in this facility must agree to sell financial securities to the Fed and repurchase them later to receive the cash.

The agreement must be fulfilled within one business day, and a penalty is imposed if the buyer is unable to purchase the securities at the agreed-upon price. This facility allows banks to access liquidity quickly and provides the Federal Reserve with a way to control the money supply.

:max_bytes(150000):strip_icc():format(webp)/repurchaseagreement_final-93b69d50a1194440803c1ce089dac8a9.jpg)

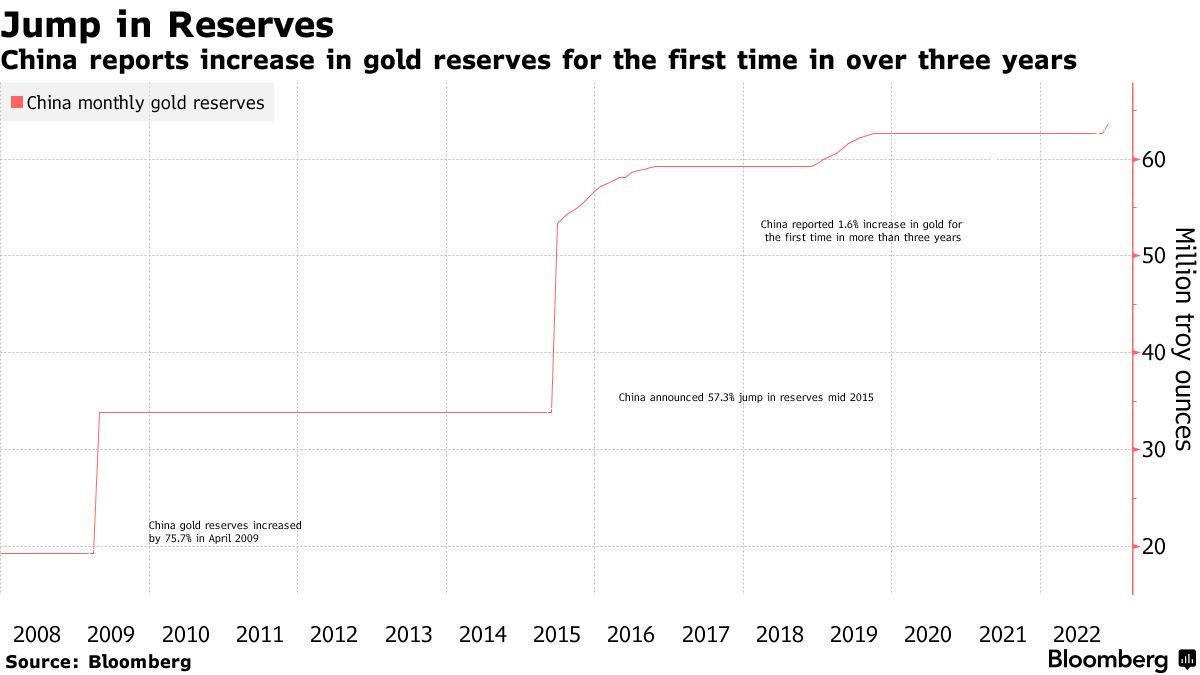

It's important to note that China and its increasing stockpiling of physical gold in constructing a new global monetary arrangement.

Credit Suisse report "War and Commodity Encumbrance" by Zoltan Pozsar released a new report a few days ago. I've uploaded the report, and you can find it here.

Zoltan Pozsar, a Credit Suisse monetary expert, has recently published a note discussing the global implications of commodity encumbrance (or the reuse of commodities as collateral) and the emergence of the Petroyuan – the Chinese yuan-denominated oil benchmark.

Pozsar argues that the shift from a unipolar world to a multipolar world driven by the “G7 of the East” (the BRICS countries) will be led by heads of state, not central banks. He argues that investors will be left behind if they only follow the actions of central banks and not the actions of heads of state.

This shift will have major implications for the global monetary system. However, one implication not discussed in Pozsar’s piece is China’s stockpile of gold. It has been revealed that China has secretly acquired hundreds of tons of physical gold, which could play an important role in the new global monetary arrangement.

Additionally, China has been accumulating stockpiles of commodities such as copper, corn, wheat, soybeans, crude oil, and aluminum – likely in preparation for a potential war. As such, it is clear that the shift from a unipolar to a multipolar world will have major implications for the global monetary system. China’s accumulation of physical gold and various commodities will play an important role in this shift.

Are you interested in more educational content?

Visit my medium page: https://medium.com/@romanornr/

Special Relationship Between Russia and China Could Undermine U.S. Dollar and Cause Higher Inflation in the West

Russia and China have a special relationship when it comes to their financial agenda, and their actions have the potential to cause big changes in the United States dollar and the U.S. Treasury market. This relationship has resulted in a new concept called Bretton Woods III, which impacts the commodity sector and could cause higher inflation in the West.

If you want to know more about the Bretton Woods, check my medium article I wrote https://medium.com/@romanornr/volatility-the-prisoners-dilemma-484893f0c80e

The relationship between Russia and China has been solidified with a series of moves, most notably China's decision to develop a "special relationship" with OPEC+, which includes Russia, Iran, and other members of OPEC.

This decision was made official through the China-GCC Summit and the creation of a petroyuan - a currency used to buy and sell oil in exchange for yuan. This development can potentially hurt the dollar’s status as the world's dominant trading currency, as there will be more non-dollar transactions.

More significantly, this move by China has created what economists have termed "commodity encumbrance" - a process that allows China to use key commodities like oil and gas in the Middle East as collateral. This allows China to make its own form of loans, often backed by commodities instead of cash, allowing them to borrow cheaply and potentially create even more inflationary pressures in the West.

Overall, the special relationship between Russia and China is an important development that has the potential to have a big impact on the global economy and could undermine the status of the U.S. dollar.

Geopolitical Risks as China Increases Energy Cooperation with GCC Countries

President Xi of China discussed China's ambitions to collaborate with GCC nations on energy over the next three to five years in a speech he delivered at the China-GCC Summit. President Xi Jinping's proposal of a new paradigm for multilateral collaboration in the energy sector makes this announcement all the more intriguing.

Long-term crude oil imports from the Gulf Cooperation Council (GCC), partnership exploration in the upstream sector, engineering services, downstream storage, transportation, and refinery, and RMB settlement in oil and gas trade via the Shanghai Petroleum and Natural Gas Exchange platform, plus currency swaps, are all on the list.

Pozsar then dissected President Xi's comments to decipher their potential market impact. He suggested considering a scenario in which oil and gas are priced in dollars and yuan and where certain oil and gas can't be supplied to the West at cheap costs because the East is in the way while calculating inflation breakeven five years into the future. However, as he put it, the market does not consider this. For another part of his research, Pozsar questioned a London-based group of inflation traders on how the market arrives at breakeven points five years into the future.

He was informed that neither top-down nor bottom-up analysis had gone into this estimate. Instead, the central bank's inflation targets are assumed, and the focus shifts to the availability of funds. This lends credence to Pozsar's claim that the geopolitical risk associated with the new energy partnership between China and the GCC has not yet been priced into the market.

This is important because it implies that we must consider how to account for the geopolitical risks brought on by this change in energy cooperation when making investments and evaluating the market.

Before continuing reading, do you enjoy reading these blog posts?

The premium subscription gives you unrestricted access to research & newsletter about stocks, options, forex and volatility, cryptocurrency, bitcoin, macroeconomics, and more.

Additionally, a Private Telegram group to ensure you get the best out of your subscription. https://romanornr.ghost.io/#/portal/signup

A New Paradigm of Energy Cooperation

A novel approach was also used by FDR when he met with King Abdul Aziz Ibn Saud. In return for low-cost oil, the United States vowed to guarantee the safety of the Saudi monarchy.

The "petrodollar" model boiled down to the following:

- The United States purchased oil from Saudi Arabia and paid for it with U.S. dollars; *

- Saudi Arabia then purchased U.S. government bonds and weapons with those dollars; *

- The United States then deposited those dollars back into Saudi Arabian banks.

(The debt crisis in Latin America in the 1980s was caused by the recycling of petrodollars deposited in the region after the OPEC shocks of the 1970s.)

Once upon a time, the conventional method was effective. Thanks to the shale revolution, the United States is less dependent on oil from the Middle East. The security situation is unstable, and China has become the world's biggest oil importer.

The Saudi government has shifted its focus from supporting the United States government and banks to investing in private companies, decreasing the kingdom's holdings of U.S. Treasuries and bank deposits. The Saudi crown prince recently announced that the country might limit its investments in the United States. The other GCC states act similarly.

The "new paradigm" between China, Saudi Arabia, and the Gulf Cooperation Council (GCC) countries is very different from the deal made on the USS Quincy. This makes sense since China now deals with the rich Middle East, and FDR dealt with the Middle East, which was starting to grow. As a region gets richer, its power and priorities change. Back then, "liquidity and security" were more important than "equity and respect."

Today, "equity & respect" are more important than "liquidity & security" for a region that has become eminent. China offered this: "all-dimensional energy cooperation" means more than just trading oil for cash and weapons. It also means investing in the region in the "downstream sector" and using the region's knowledge to work together in the "upstream sector." The "upstream sector" could mean exploring oil together in the South China Sea. Also, Xi's plan for "all-dimensional energy cooperation" includes working together on "localized production of new energy equipment" (see here).

In other words, "oil for development" (plants and jobs) pushed "oil for arms" out of the way. The Belt and Road Initiative and Saudi Arabia's Vision 2030 were win-win for everyone.

Bybit 4th anniversary

Sign up & receive Up to $1 million in prices

China's President Xi announces move to new economic paradigm not reliant on U.S. dollars.

President Xi Jinping pledged in his address that China would abandon its reliance on the U.S. currency as it pursues economic growth. He also said that the Renminbi would be used to pay for increased oil and gas purchases from the Gulf Cooperation Council (GCC) members.

This is a significant change because it would mean that the GCC would no longer have to sell their exports in U.S. dollars. It would also give them a much bigger market for their oil and gas since China buys most of these things.

This change means a few different things. First, it would increase the demand for the Renminbi because the GCC would have to change their dollars into the Renminbi to buy oil and gas from China. This would probably make the Renminbi stronger against the dollar.

Second, the GCC would have to find ways to reuse their Renminbi because they couldn't turn it back into dollars. It could also be turned into gold. One way to do this would be to put money into projects to improve China's infrastructure.

The PBoC revealed that during 2022, it had re-started gold purchases with gusto.

This is good news for the GCC because it will make them less reliant on the dollar and give them a bigger market for their oil and gas. It's also good for China because it will make more people want to buy the Renminbi and help spread the currency worldwide.

China's m-CBDC Bridge project could shake up the global economy.

The People's Bank of China (PBoC), the Bank of Thailand (B.T.), the Hong Kong Monetary Authority (HKMA), and the Central Bank of the United Arab Emirates (CBA) are working together on a project called the m-CBDC Bridge, and Chinese President Xi Jinping emphasizes its significance in his recent address. This initiative paves the way for CBDCs to be used in real-time, cross-border, foreign exchange transactions that don't rely on the U.S. dollar or the network of Western correspondent banks that underpin the U.S. dollar system.

This implies that China wants the Gulf nations to accept payment in e-renminbi on the m-CBDC Bridge platform so that it may use its own currency, the Renminbi, to buy oil from them. To make the U.S. dollar secondary to other currencies in international commerce would be a radical departure from the status quo.

This is a huge deal that may completely change the course of the world economy. The development of the m-CBDC Bridge and international responses to China's effort will be crucial to track.

President Xi Jinping Pushes for Currency Swap Agreements to Bypass U.S. Dollar

President Xi has mentioned beginning "currency swap cooperation" as the fifth and final point.

To clarify, President Xi is discussing a currency exchange deal between China and another country. The arrangement would include China exchanging a certain quantity of yuan for foreign currency. The elimination of the requirement for U.S. dollars in commerce would be seen as a positive step toward fostering economic growth in both nations.

According to Zoltan, this is much like the Lend-Lease deal that the United States and the United Kingdom made during World War II. The United States provided financial assistance to the United Kingdom so that it could finance the purchase of weapons with which to engage in a defensive war against Germany. Essentially, China is lending nations like Saudi Arabia renminbi so they can acquire climate change mitigation supplies.

China's desire to lessen its reliance on the U.S. dollar's global monetary system is further shown by the m-CBDC Bridge project. This initiative aims to facilitate cross-border payments via means other than the conventional banking system by connecting several central bank digital currencies (CBDCs).

This is related to President Xi's previous call for a "multipolar world order" in which the United States is not preeminent. China is preparing itself to be a key participant in the global economy by introducing other payment mechanisms and seeking to lessen dependency on the U.S. currency.

Conclusion of this section from Pozar

Take a step back and consider that since the beginning of this year, 2022, Russia has been selling oil to China for renminbi, and to India for UAE dirhams; India and the UAE are working on settling oil and gas trades in dirhams by 2023; and China is asking the GCC to “fully” utilize Shanghai’s exchanges to settle all oil and gas sales to China in renminbi by 2025.

Zoltan puts it.

Dusk for the petrodollar… and dawn for the petroyuan

Okay, let's discuss what he means by "Dusk for the petrodollar… and dawn for the petroyuan" in a quick rundown.

- The U.S. dollar is the de facto standard for pricing and settling global oil transactions, thus the petrodollar nickname. The Chinese yuan, or petroyuan, is gaining traction as a means of payment in the oil industry.

- Pozsar is saying that Russia, India, and the UAE are all moving towards settling oil and gas trades in currencies other than the U.S. dollar and that China is leading the way. This is a major shift away from the petrodollar and could have major implications for the U.S. economy.

- There are a few reasons why this shift is happening. For starters, the United States dollar is gradually losing its position as the world's reserve currency, which means that other countries are less reliant on the dollar. Second, it is difficult for countries like Russia and Iran to do business with U.S. dollars due to restrictions imposed by the United States. Third, as China's economy and military grow, its currency also gains international acceptance.

Commodity Encumbrance and Its Impact on the Economy

Now let's move on with the discussion on commodity encumbrance and rehypothecation, two important topics that have garnered attention in recent years.

The process of utilizing the same commodity as collateral for repeated loans, transactions, or derivatives is known as rehypothecation or commodity encumbrance. Market inefficiencies and price increases, or "printing" inflation over inflation expectations, may result from excessive encumbrance and a shortage of goods.

When commodity encumbrance is common, a certain piece of collateral may be trading at a significant discount to overnight index rates, indicating a severe collateral shortage. If this process is allowed to go too far, it may increase consumers' costs and lower their trust in the economy as a whole.

The need to understand the ramifications of commodity encumbrance to prevent market inefficiencies and a drop in consumer confidence. Therefore, it is essential to understand rehypothecation, recognize when encumbrance is excessive, and take corrective action.

A "commodity encumbrance" is a financial transaction in which commodities (often oil or other natural resources) are pledged as collateral. Encumbered goods are those that have been promised in this manner and can no longer be utilized for their original purpose. Excessive encumbrance may reduce available collateral, resulting in increased loan rates and inflation.

China & OPEC+ Forge Special Relationship, Offering Discounted Oil Prices

Discounting oil prices for large consumers like China, Iran, and other OPEC+ members is known as "encumbrance" in the oil and gas markets. An encumbrance arises when nations like China and Iran are given a discount on the six-month rolling mean price of similar benchmark items and an extra 6-8% in risk-adjusted compensation.

This allows nations to stock up on oil at a lower cost. Since 2016, China and Russia have had a unique partnership, with China paying Russia in Renminbi for oil at a discount. Furthermore, since 2021, Iran and China have had a Comprehensive Strategic Partnership, which has allowed China to purchase oil from Iran at a reduced price. Since its first 2019 offer, China has also asked the GCC for oil at a discount in exchange for the Renminbi.

To put it simply, OPEC+ permits nations to pay lower oil prices in return for investments in downstream petrochemical industries (refining and plastics) and expenditures toward transportation and industrial infrastructure. To create the organization, these pacts have been essential in bringing together OPEC+'s current members—the Islamic Republic of Iran, Iraq, Saudi Arabia, Kuwait, and Venezuela. Following Russia's 2016 entry into OPEC are the countries of Qatar (1961), Indonesia (1962), Libya (1962), the UAE (1967), Algeria (1969), Nigeria (1971), Ecuador (1973), Gabon (1975), Angola (2007), Equatorial Guinea (2017), and Congo (2018).

China's Renminbi Push to Capture Over Half of the World's Proven Oil Reserves

If oil deals worldwide are to go from being settled in U.S. dollars to the Chinese yuan, the effects of this change must be carefully considered. According to Zoltan's estimates, 40% of the world's known oil reserves are in Russia, Iran, and Venezuela, all of which sell oil to China for yuan at a significant discount. As a result, China now has the edge over countries whose oil trades are conducted using the U.S. dollar. China has been actively courting the other 40% of OPEC (Gulf Cooperation Council) members to likewise accept the yuan in return for transformational investments, a so-called "new paradigm," to consolidate its grip on global oil prices further.

North and West Africa and Indonesia have the remaining 20% of known oil reserves. Russia dominates North Africa, China dominates West Africa, and Indonesia is pursuing its own goals. As a result of this change in the global oil market, a phenomenon known as "Commodity encumbrance" has emerged, which means that China will not only buy more oil with yuan over the next several years but will also get more value-added activities at the cost of Western enterprises. Evidence of this can be seen in Europe, where BASF has opted to permanently reduce activities at its major facility in Ludwigshafen to shift part of its chemical operations to China.

When someone pledges collateral to a dealer, they are encumbering that collateral in the eyes of the dealer. Finally, the dealers rehypothecate the collateral.

China’s “Commodity Rehypothecation” Poses Risks to Market Participants

Consider what it means if governments substantially discount oil and locally manufactured chemicals to entice trade partners to pay in Renminbi (the currency of the People's Republic of China). This practice is known as "commodity rehypothecation," and Zoltan coined it.

Chinese LNG (liquefied natural gas) has become a significant export from China to Europe, whereas Indian oil and refined goods like diesel have become significant exports from India to Russia. Zoltan anticipates that this trend will expand to include even more items billed in non-standard currencies in the future.

Commodity encumbrance also has an "institutional" aspect, with nations like Russia, Iran, and Venezuela "pledged" their resources to the aims of the BRICS (Brazil, Russia, India, China, and South Africa) and China's Belt and Road program. This is why President Putin has floated the idea of establishing a worldwide reserve currency composed of a "basket of currencies" from different nations.

Consider the effects of commodity encumbrance on market participants and their investments because of the United States Department of Defense's interest in de-dollarization (as demonstrated by the Rising Power Alliances Project at the Fletcher School of Tufts University). Keep a close eye on the news, and include commodity encumbrance to their list of things to consider.

A Possible Counter to the U.S. Dollar: Putin's "BRICS Coin" Gains Momentum

Keep an eye on the progress of Russian President Vladimir Putin's plan for a "BRICS coin," an international reserve currency that would function similarly to the SDR (Special Drawing Rights).

An alternative to the U.S. dollar for nations in the Eastern and Southern economic blocs might be provided by the "BRICS coin," should it be adopted as a global currency reserve. Serguei Glazyev, the Eurasian Economic Commission's minister in charge of integration and macroeconomics, and a close ally of Vladimir Putin, initially presented the proposal in 2019.

Institutionalized commodity encumbrance, which involves countries setting aside some of their natural resources in return for enhanced currency reserves and credit capacity, is the central theme of Glazyev's critique of the initiative. Glazyev has suggested bilateral exchange lines between nations with whom one does business to ease commerce and investment.

Saudi Arabia and Qatar, half of the GCC, were recently given dialogue partner status by the Shanghai Cooperation Organization (SCO), which has also begun the process of admitting Iran as a member. It's possible that this, along with applications from additional nations to join the BRICS, means that the "BRICS currency" is gaining steam and becoming more established as a viable alternative to the U.S. dollar.

Belt and Road Initiative and BRICS Coin

The potential inflationary effects of the Belt and Road Initiative (BRI) on international bond markets. The BRI is China's initiative to improve infrastructure throughout Eurasia and the Middle East. A Credit Suisse analyst speculated that President Xi's description of the BRI as "a garden of civilizations" in Riyadh suggests a tranquil zone where competitor governments are cordial toward each other. This is important because peace in the area is crucial to the success of the BRI.

For this to happen, competing superpowers like China and Russia must make friends with their opponents. They need to form a cooperative trade arrangement that benefits both parties. The big powers of the Eurasian continent are already in a special connection. Each of them has excellent ties with each of the great powers of the Middle East, making this an increasingly challenging task.

The rest of this article is for premium members only

The premium subscription gives you unrestricted access to research & newsletter about stocks, options, forex and volatility, cryptocurrency, bitcoin, macroeconomics, and more.

Additionally, a Private Telegram group to ensure you get the best out of your subscription. https://romanornr.ghost.io/#/portal/signup