Market newsletter Feb 9 - 2023

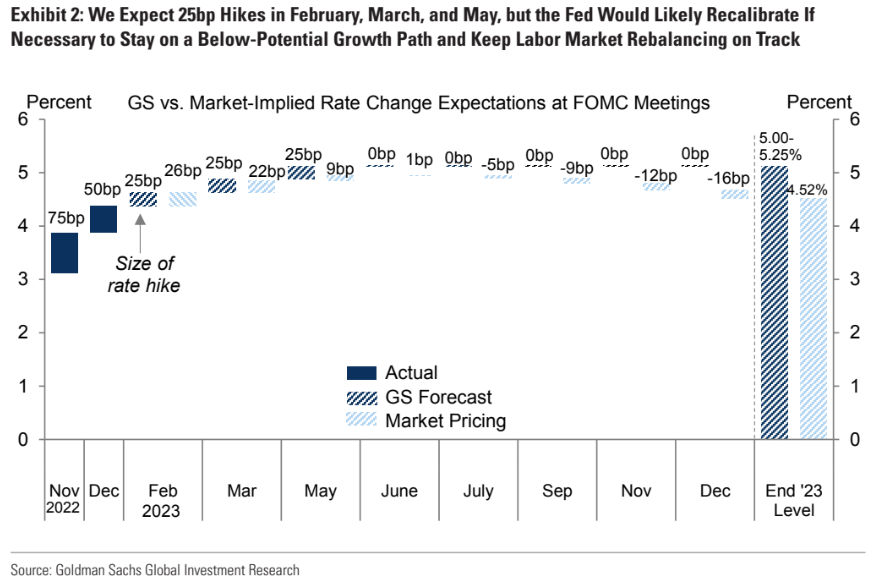

This week market participants were on the edge of their seats as Jerome Powell took the stage at the Economic Club of Washington and began to speak. While the markets had interpreted his FOMC post-meeting conference last Wednesday as dovish, many wondered if they would take a hawkish stand after the unexpectedly strong Employment Report 517k non-farm payroll growth and a 3.4% unemployment rate from the week before. However, Jerome Powell did mention that if more data like Frinday's Employment Report comes in, they may have to do more than originally anticipated.

I am not quite sure why that is, to be honest, but assume that if the data is showing a stronger than expected growth, it indicates that the economy could be further along in the recovery than previously anticipated; if that's the case, the Federal Reserve will likely have to adjust there and possibly even hike rates higher to ensure that inflation stays within its target range.

Jerome Powell explained that the target for inflation is not going to change and said that it will take some time until 2024 to get close to their goal of 2%. Jerome Powell also talked about how the labor demand is much bigger than the current supply and appears more structural than cyclical.

Now you may wonder what the difference is between "structural & cyclical"

I will try my best to explain it in this context

Structural unemployment

Structural unemployment is long-term, usually due to structural changes in the economy. This type of unemployment could be caused by a mismatch between the skills required by employers and the skills possessed by workers.

Cyclical unemployment

Cyclical unemployment is caused by the normal boom and busts during a business cycle. This type of unemployment happens when there's a slowdown in economic growth, which leads to a decrease in demand for goods & services (lowers GDP). When people are laid-off, unemployment rises (obviously). Still, when the economy begins to pick up and demand for goods & services increases, businesses start to hire more workers, and unemployment falls.

A boom & bust within a business cycle is unavoidable. I call it a feature of capitalism. Check out this Investopedia link by clicking here

Target inflation catch-22?

The target inflation rate is 2%, and central banks worldwide would have to raise interest rates. This can have a large impact on the markets. In Australia, the RBA hiked its rate to 3.35%. Continuation of rate shakes may be hard to stomach for people who have invested in retail properties, and instead of selling their properties, they may opt to raise the rent to cover their costs. That can lead to an increase in rents as there is a shortage of housing, meaning less homes are being built as the rates rise. That could lead to a deflationary collapse in demand for rental properties as more money from renters goes to property owners.

Alternatively, renters may insist on higher wages to cover the increase in rent costs. That would lead to higher wage growth, which in turn causes higher inflation.

Understanding the structure of the economics at play to make an informed forecast is difficult. The power balance may impact the economy, so it's important to ensure all factors are considered to ensure accurate projections. Interest rates continue increasing, and wage growth may increase, leading to higher inflation.

Riskbank

Riskbank will hike their interest rates by another 50 basis points today to help build confidence in the Krone. A hawkish stance is required despite deteriorating economic and property market conditions.

Ethereum Shanghai upgrade

Ethereum ecosystem is on a journey that could redefine staking for its validators due to the Shanghai upgrade. By March, validators can withdraw ETH that has been locked since December 2020, which could happen partially or wholly. Partial withdrawal will mean validators can only withdraw the accrued rewards, not their initial staked Ethereum. Those who opt for a full withdrawal will completely exit the network.

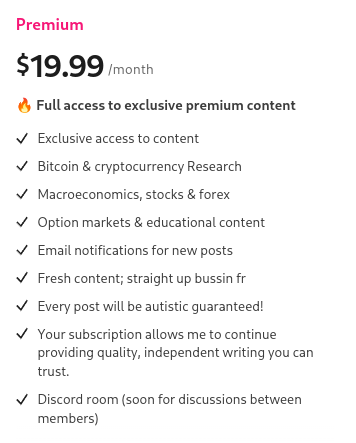

Premium subscription

Tired of seeing low-effort content on Twitter with random people posting lines on a chart?

Maybe subscribing to this newsletter is something for you to gain an edge over the market.

Read this content, and give your wife the impression that you actually know what you're reading instead of being a compulsive gambler using "Technical Analysis" (Astrology for men) only.

Also, read my free medium articles: https://medium.com/@romanornr/

Full access to exclusive premium content

Subscribe, and get a competitive edge over the market.

Take the first step to kick your wife's boyfriend out of the house & stop getting liquidated.

(This section was for premium members only, but released for everyone on February 25)

The upgrade requires validators to update their withdrawal credentials beforehand. Currently, only 60% of the half-million validators have done so, and the rest needs to do this seen.

The rewards will be sent to their address automatically for those who have updated their credentials. In case of a full withdrawal, a validator must manually request an exit. A maximum of seven exits can be processed in the network per epoch every ~6.4 minutes, which works out to 1600 validators' exits per day. If many validators chose to exit simultaneously, the difficulty and delay could be longer as the process is slow.

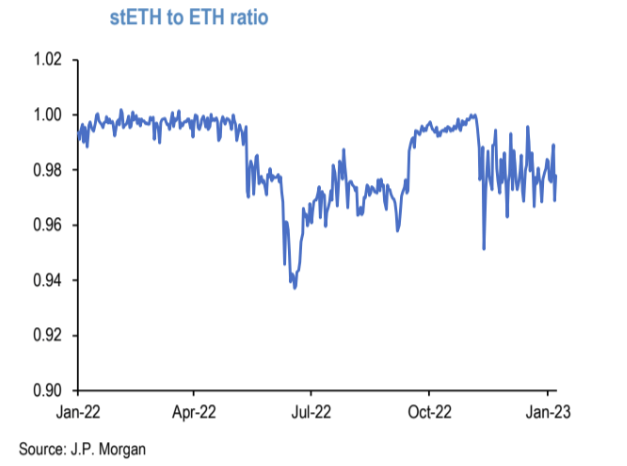

An influx of liquid staking protocols like Likdo has also been seen. These protocols enable ether holders to stake fractions of Ethereum without the need to post a minimum of 32ETH threshold. Not only that, these liquid staking protocols provide liquidity for staked assets that would otherwise be locked. By the time the upgrade goes live, the derivative token of these liquid staking protocols should converge in parity with the underlying asset.

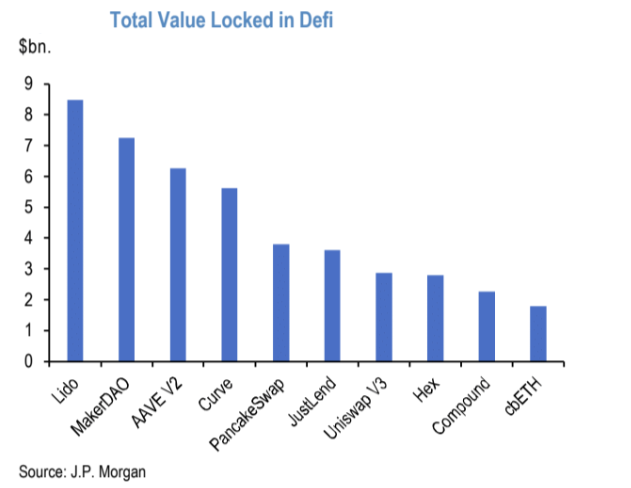

The shanghai upgrade and liquid staking protocols have created opportunities for retail investors that could not previously stake due to the 32 minimum stake amount threshold. That has led to these protocols becoming some of the biggest DeFi players, with Lido surpassing MarkerDAO in terms of Total Value Locked (TVL).

All in all, the coming months will be an exciting time for the Ethereum network, with staking getting a much-needed boost in the form of the Shanghai upgrade and liquid staking protocols providing much-needed liquidity for staked assets.

Lido's Dominance of the Liquid Staking Space Raises Concerns

The ethereum network is constantly evolving, and with this evolution comes opportunities. Last September, "The merge" was a monumental part of this evolution, bringing considerable benefits such as reducing power consumption and Ethereum's inflation rate.

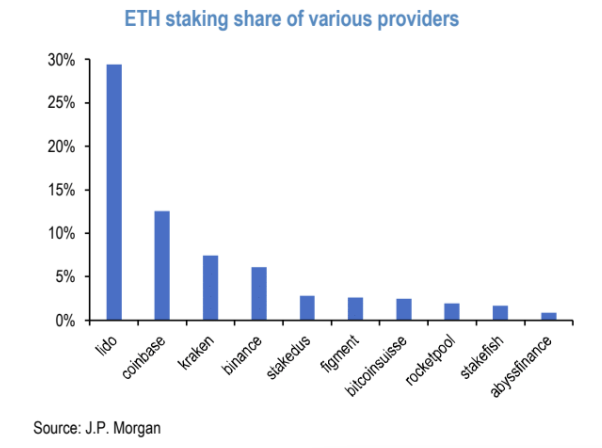

Unfortunately, this merge has also increased centralization as a select few entities, such as liquid staking protocols, now hold a majority of the staked Ethereum. Currently, Lido is the largest liquidity provider in the staking space, commanding more than 30$ of the market share of staked ETH and a higher share in the overall liquid staking space.

This concentration of ETH has caused some concerns among people within the ecosystem, leaving them to ask how this might impact the security and health of the Ethereum network, which is yet to be seen; this will be an important issue to watch in the coming months.

Shanghai Upgrade to Increase Ethereum Staking Yield Significantly

The upcoming Shanghai upgrade is expected to cause a major shift in Ethereum's staking ability & yield. Currently, each validator with 32 ETH is getting a total staking yield of 7.4%, including variable rewards from transaction fees, tips, and MEV (Maximum Extractable Value).

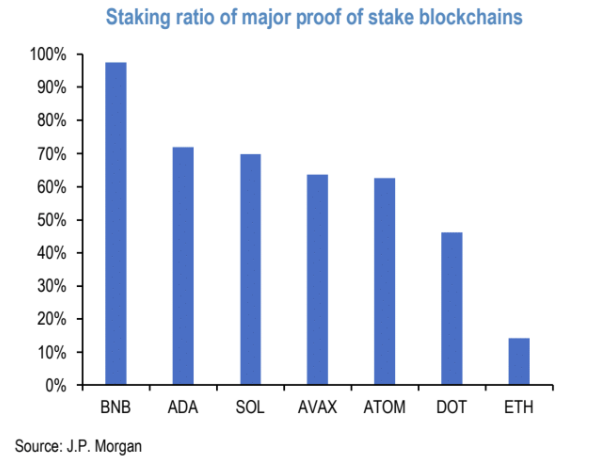

Compared to other Major PoS networks such as Avalanche (AVAX), BNB, Polkadot, and Solana. Ethereum has a relatively low staking ratio of only 14%, so after the upgrade, there's room for the staking ratio to increase to the average of the networks, which is ~60%

If that happens, the number of validators would jump from 0.5 million to 2.2 million, and the yield would decrease from 7.4% to around 5%, therefore with the Shanghai upgrade, Ethereum has the potential to become one of the leading PoS players within the crypto space and offer rewarding yields to validators.

Monitor The Standard Block Rewards and Variable Rewards

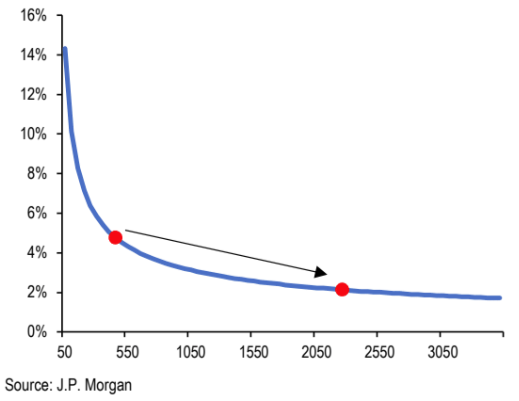

Explaining this graph of the validators and the yield

Assume you are a validator on the Ethereum network, responsible for confirming and processing transactions. As a validator, your main goal is to maximize your staking yield, which is determined by the number of validators present in the network. The graph illustrates how the staking yields correlate with the number of validators in the network.

The increase in standard block rewards to the validator set as the number of validators increases that increases the standard block reward helps to offset the variable rewards such as transaction fees, fee bumps given by the users to prioritize certain transactions, and MEV, which are rewards earned through reordering transactions before sending them into a block on the network. As more people use the network and more activity is present, the variable rewards earned will also increase and contribute to your overall staking yield.

By keeping track of the rewards earned along with the stand block rewards, you can be sure to experience the highest staking yield possible, helping you to take advantage.

Bitcoin

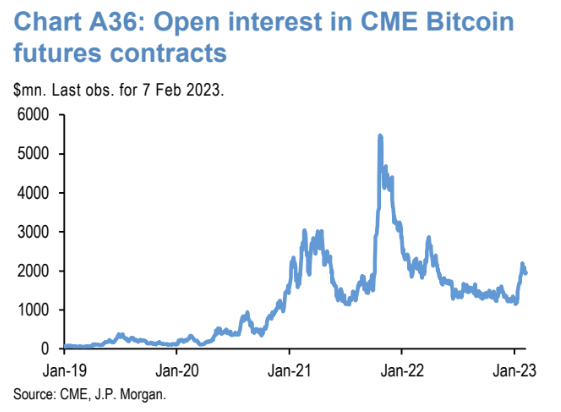

OI in CME Bitcoin futures

Open interest in CME Bitcoin futures contracts is measured in millions of dollars as of the last observation date of February 7th, 2023.

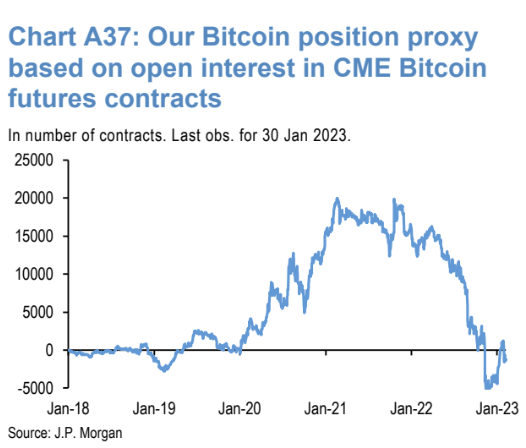

Bitcoin Position proxy based on OI in CME bitcoin futures contracts

The Bitcoin position proxy measures the total number of open CME Bitcoin futures contracts outstanding on January 30th, 2023. This figure can be used as an indication of the amount of exposure at this given point in time.

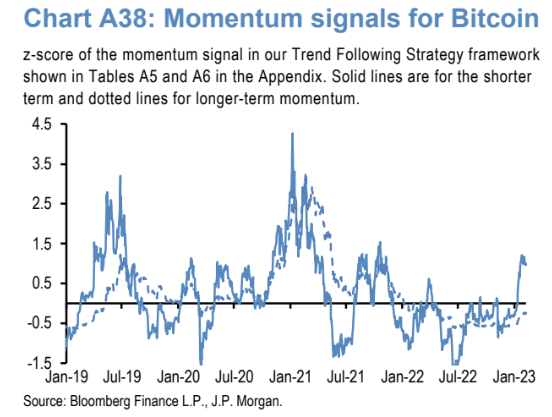

Momentum signals for Bitcoin

JPM's short-term momentum signal for BTC turned positive before Jan 23. The long-term z-score is still below 0.

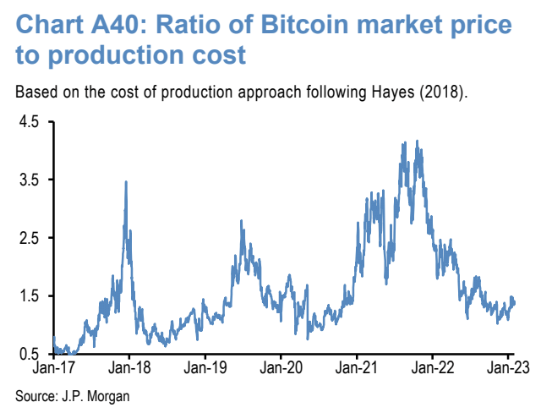

The ratio of the current market price of Bitcoin to the estimated cost of production

following the methodology outlined by Hayes (2018).

This methodology outlined by Hayes involves estimating the cost of producing 1 bitcoin by summing the costs of energy and hardware required for the mining process. The cost is then divided by the number of new bitcoins produced in each block, providing an estimated per-coin cost of production. The ratio can be compared to the current market price of Bitcoin to determine if it is overvalued or undervalued.

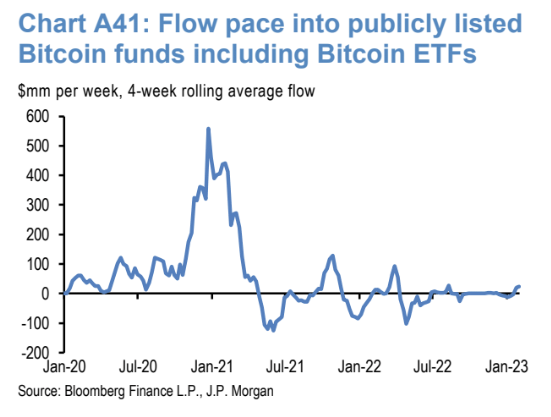

Flow pace into publicly listed Bitcoin funds, including Bitcoin ETFs

Monitoring the rate at which investors invest in publicly traded Bitcoin-related funds and exchange-traded funds (ETFs).

These funds that offer ETFs offer investors an easy way to invest in and gain exposure to bitcoin without having to actually buy bitcoin, manage their wallets, and all technical difficulties.

The flow rate can provide insights into investor sentiment and market trends related to bitcoin.

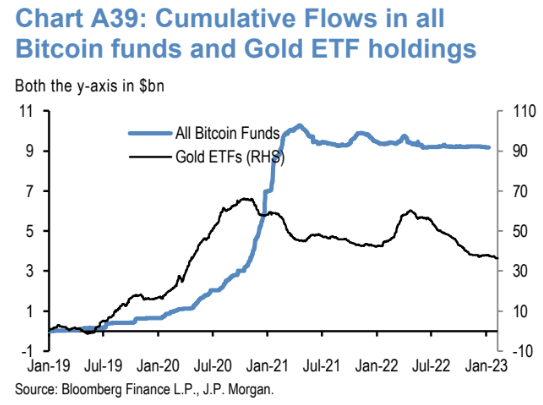

Cumulative Flows in all Bitcoin funds and Gold ETF holdings

Analyzing the total amount of money that has been invested in Bitcoin funds and Gold ETFs over time

The cumulative flows in all Bitcoin funds and Gold ETF holdings is a process that looks at the trend of the total money invested in Bitcoin funds and gold ETFs over a certain length of time to measure the performance of the investments, compare the returns between the 2 assets and indemnity any shifts in the markets which could be advantageous to a firm's portfolio.

Looking at this, one can make more informed long-term decisions on when to buy/sell or rotate between these two.

Airdrops etc

Sei Network

Airdrop hunting pic.twitter.com/XocREVsk33

— Romano (@RNR_0) February 5, 2023

Shardeum airdrop?

Shardeum is the latest Layer 1 network to enter the marketplace in pursuit of users. Recently, the startup received a major boost of $18 million in funding from a renowned VC firm, Jane Street.

The process is convenient and straightforward for those interested in trying out the network, with tutorials available at the Shardeum website and MetaMask/Blockwallet

Additionally, users can receive free testnet tokens from the Shardeum faucet and select from multiple projects and services listed on the platform.

Step 1: Add Shardeum network to your Metamask or Blockwallet by visiting

Step 2: Get testnet tokens

Step 3: Use a couple of projects listed

Gitcoin passport

it is important to possess an up-to-date Web 3.0 Passport for protection against Sybil attacks. Sybil attacks involve an attacker creating multiple accounts to increase their chances of gaining something.

To tackle this issue, teams have resorted to retroactively airdropping tokens, which can be expensive and inefficient. On-chain identity is one of the solutions that can be used to identify accounts with people more accurately, as opposed to bots.

Creating a Gitcoin Passport is a great way to be prepared for situations like when a project announces that only Gitcoin Passport holders will get access to something. Gitcoin is well-known within the Ethereum community, so ensuring your passport is up-to-date is vital before a project’s website is overwhelmed by too much traffic.

Blockwallet

I've been recommending Blockwallet in several tweets.

I made the switch from Metamask to Blockwallet.

The user interface and functions are much better; it works better with my Trezor and switching between accounts. Extra privacy, flash bot protection & anti-phishing. You can also import your Metamask seed, etc.

However, I've seen one of their latest tweets, BlockWallet has a token called "BLANK"

Kicking off the new year with some heat - the $BLANK token burn 🔥 pic.twitter.com/rm83xOo0wt

— BlockWallet 🔲 (@GetBlockWallet) January 16, 2023

If I were a betting man, which I am. I will assume that Blockwallet users are eligible for a nice airdrop. I would recommend installing Blockwallet and making some transactions.

You can export your Metamask seed and import it into Blockwallet. There's no need to reshuffle your assets etc., as some people think. Some people don't want to make the switch because Blockwallet has no mobile app right now. It doesn't matter. You can install Metamask or 1inch wallet on your phone and import your seed on your mobile wallet, which is not Blockwallet.

Chrome extension link: https://chrome.google.com/webstore/detail/blockwallet/bop

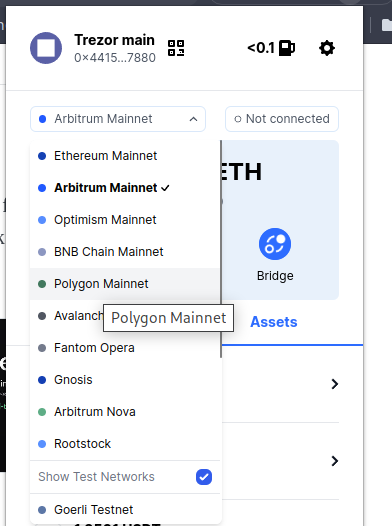

Gtrade

I've noticed this interesting DEX. So gTrade has a really nice UI but also has forex and stocks. I am still playing with the DEX. I recommend using the Polygon network to trade on the.

Again, switching from network and bridging is easy with blockwallet

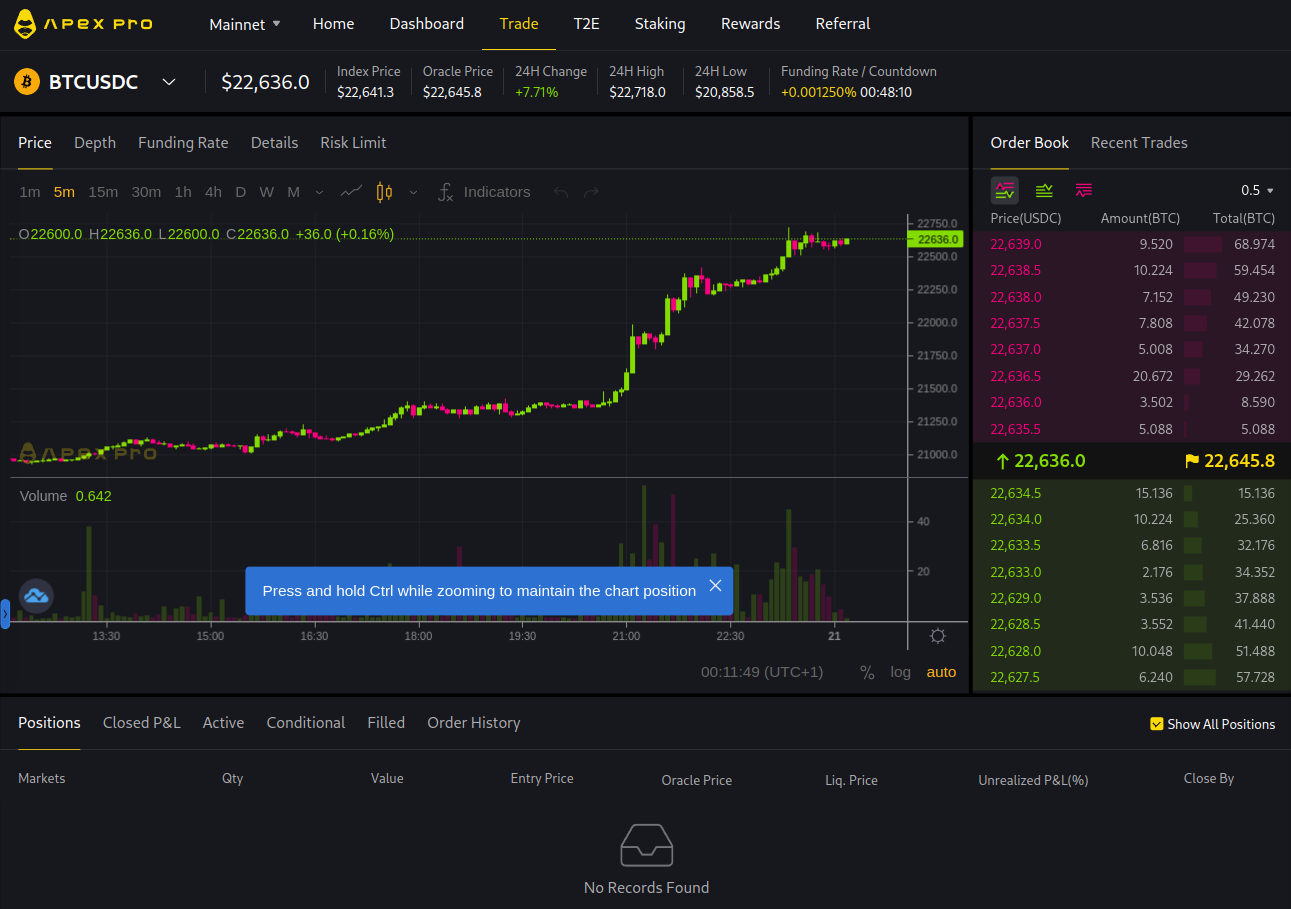

Apex Dex by ByBit

Reminder Apex incentive program, which pays you to trade and keep tour trade open, is ongoing.

They pay rewards to keep that position open lmao

— Romano (@RNR_0) January 12, 2023

Grand idea (however, maybe it won't work)

Use 1 wallet to long x amount

Use 1 wallet to short same amount

Farm rewards neutral?

Discount ref link code: https://t.co/JsJlHH5k3s

Ref code = 46

disclaimer: I hold 1 ApeX OG NFT pic.twitter.com/SgtbrREWS6

Think I can close it for a moment now

— Romano (@RNR_0) January 16, 2023

I like trading on Apex. I get rewards in BANA tokens as a reward

Basically, 1/3 position size as a reward/incentive to trade@OfficialApeXdex is a DEX from ByBit

Interface identical

Can recommend trying out https://t.co/JsJlHH5RT0 pic.twitter.com/Le0Y0y8X9d

If you need a referral link: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

My referral code is: 46

In my opinion, this is the best DEX for trading bitcoin futures.

They also have a mobile app, Android:

Also, an app for iPhone

Ref code = 46

Become an affiliate of this newsletter.

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me, as compensation for promoting/sharing the newsletter with others.

Payouts can be in crypto or through a bank.

Newsletter affiliate

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me as compensation for promoting/sharing the newsletter with others.

In case you missed the previous newsletter and airdrops, mentioning once again

Filecoin airdrop

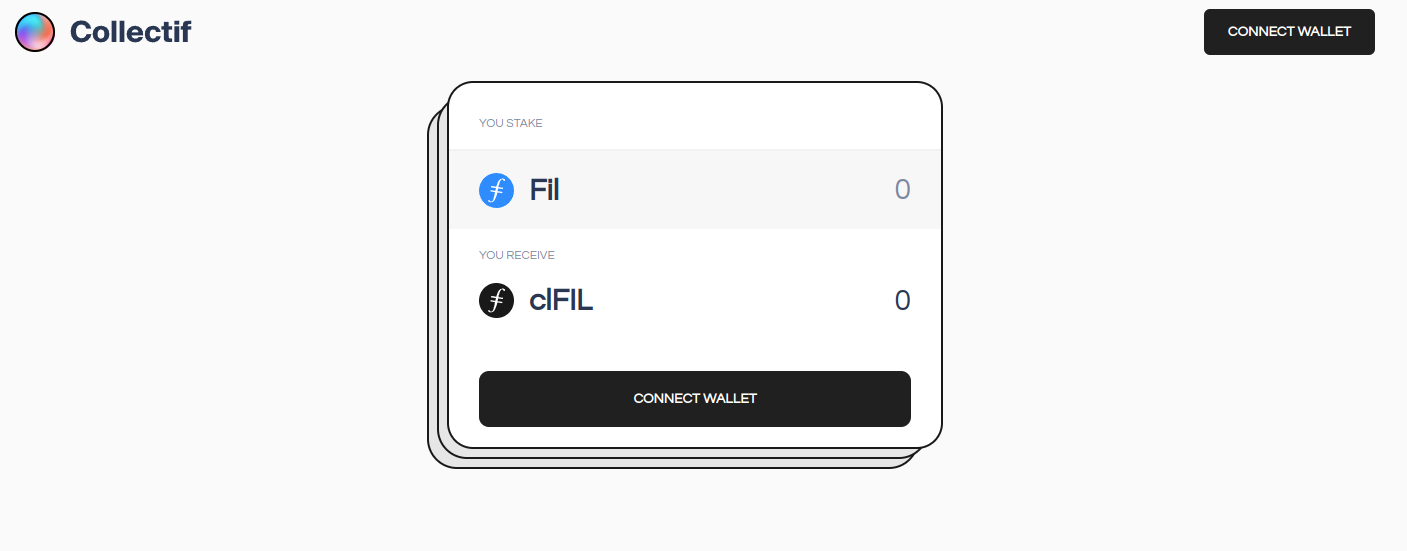

The Filecoin EVM chain is a powerful network that is currently underutilized. To start using the network, CollectifDAO is a great option.

It's a liquid staking protocol that serves a dual purpose - it operates as both the Filecoin testnet and a platform for issuing Liquid Staking Derivatives (LSDs).

Liquid Staking Derivatives (LSDs) are a type of financial instrument that allows users to benefit from cryptocurrency ownership without holding the underlying token. This is done by taking out collateralized loans where the underlying asset is used as collateral.

They can be used for hedging and speculation to gain exposure to the cryptocurrency market without holding the coins themselves. LSDs have become increasingly popular in the decentralized finance (DeFi) space as they offer a way to maximize profits while minimizing risk.

Visit: https://app.collectif.finance/

Add: https://chainlist.org/chain/3141

Testnet filecoins: https://hyperspace.yoga/#faucet (put in address)

You receive 5 FIL

Stake 4.5 FIL for clFIL (Not all 5, just 4.5)

Scroll airdrop

Scroll is a testnet that uses zero-knowledge proofs, like the networks employed by zkSync and StarkNet.

You can get some test funds from the Faucet tab, bridge funds between networks with the Bridge tab, and swap some funds via the Swap tab.

Scroll is actually two separate networks, so you will need to get funds for both networks separately or use the bridge to transfer funds from one network to the other.

It's a bit confusing, but here's a video I made that might help