Market newsletter Feb 23 - 2023

The Federal Open Market Committee (FOMC) minutes from the February 1 meeting highlighted an interesting pattern of hawkishness within the board.

The members ultimately decided on the smaller rate hikes after debating between a 25 bps and a 50 bps rate hike. To bring inflation back to the 2% target, all panelists agreed that lowering the Federal Reserve's securities holdings is needed.

However, financial conditions have eased, possibly necessitating further rate hikes, as some board members have argued.

The market is still pricing in a 30 bps rate hike and a terminal near 5.40%.

A terminal near 5.40% is a long-term estimate of the rate the Federal Reserve will reach at the end of its policy tightening cycle. This means that after a series of rate hikes in the near term, the Federal Reserve will eventually reach a terminal rate near 5.40%.

USD OIS rates, also known as "overnight index swap rates," are used to gauge expectations for future rate hikes.

Equities have done well despite a rise in nominal and real yields. We should proceed with caution, however. This uptrend in equities is vulnerable to a correction. This dislocation between yields and equities might indicate further monetary policy restraints is important for bringing back inflation to the desired 2% target.

Close watch on inflation despite the softened language

The FOMC is closely monitoring inflation, and although they have softened their language, they're still anxious about the possible inflationary threats.

Recent figures have shown a decrease in the rate of price increases, but they want to see a broader range of price drops before they can be sure that inflation is on a stable decline.

These price declines are driven by easing supply chain bottlenecks.

However, there are worries that these improvements won't last. On top of this, there hasn't been much sign of a decrease in services such as housing due to the tight labor market and increased wage inflation. The FOMC remains alert to any potential inflationary risks.

Rush to capitalize on deteriorating conditions in emerging markets

As the economy showed signs of reacceleration, a quick unwind of USD shorts while at the same time.

Real money investors, such as hedge funds, mutual funds, etc., have been positioning themselves to take advantage of the worsening conditions in the markets during January by establishing long positions in back emerging market assets.

That indicates that these investors believe that the 'goldilocks' backdrop, which has been present in the markets during January, is beginning to deteriorate. They are seeking to capitalize on opportunities that may happen.

JPY longs remain popular ahead of potential BOJ policy changes

The Japanese Yen (JPY) is expected to remain strong among investors on expectations that the Bank of Japan (BOJ) may soon change its monetary policy.

As a result, many expect the JPY to remain strong, as any changes in the policy from the BOJ could have a significant on the performance of JPY.

Investors will likely continue to maintain long positions in JPY to take advantage of potential gains resulting from changes to the BOG policy.

AUDUSD

The minutes from the Reserve Bank of Australia (RBA) showed the Board was leaning towards a rate hike of 50bps and dismissing the idea of a pause in rate hikes. Markets expect the bank to raise rates by 24bps at their next meeting and reach a terminal rate of 4.28%.

The RBA's recent decision and data regarding the Wage Price Index will likely affect the Australian dollar.

The 50bps rate hike anticipated by the RBA will likely put pressure on the AUD, but the actual rate increase could be lessened by weaker-than-expected data from the Wage Price Index.

The higher terminal rate of 4.28% could also put further downward pressure on the AUD. Overall, the RBA's actions and the upcoming Wage Price Index data are likely to impact the direction of the AUD.

DXY & VIX: Connecting evidence for market stress?

DXY and VIX should be closely watched. DXY (Dollar Index) reflects the strength of the US dollar compared to a basket of other currencies. The VIX is a measure of the expected volatility in the SPX500 stock market and is often seen as a risk aversion in the market.

These 2 seem to have a connection now. They both can be used to measure the level of risk in the markets. When the DXY rises and VIX increases, it's an indication that investors are chasing the dollar due to an increase in risk aversion. This heightened level of market stress may be caused by multiple factors, such as geopolitical risk, economic uncertainty, or news about the company's performance and earnings.

While the DXY and VIX are not perfect substitutes, a close monitoring of the two can give an indication of the underlying stress of the market.

SPX500 remaining fade

Now the first and second month of 2023 is almost over, and we had a great start in the financial markets, actually, a fantastic start, as Goldman Sachs stated a couple of days ago.

This month's straightforward story of the macro environment has been reassuring for bulls across the markets. Both in the legacy markets and the crypto markets. It looks like the stars are aligned! Inflation is falling, and employment numbers look okay. Policymakers seem to have things under control.

We have seen some people declaring that the "soft landing" is real, inflation was transitory after all, the pain was just for one year, and the fear of a recession or depression was overblown. It seems like we got injected with 5ml of hopium.

Reality check, taking a closer look at "recover"

Although some may be hasty in drawing judgments, dunking on "bears" for missing the bottom, the facts are still available.

Even with indications of improvement, it seems like we collectively have the memory of a goldfish. It seems like we forgot we are still in the aftermath of the epidemic, and complicated geopolitics and the full extent of its effect have yet to be seen.

We must maintain some skepticism and reasonable expectations, especially concerning the core PCE (Personal Consumption Expenditures), which may have trouble meeting the 2% target.

Even while things may appear good on the surface, we need to take a step back and try to confront reality.

Since the start of this year, the old diversified 60/ 40 portfolio strategy (60% equities, 40% bonds) has been working again. According to market data, it has been the most profitable strategy this year again since 1987.

However, continue with caution. Maybe a "set and forget" overleveraged long and "long your longs" might be a bad idea as you might corner yourself into a risky position. As GS suggests, try to keep taking profits by selling your bags into strength if the S&P500 reaches around $4000 - $4300

A sane person doesn’t want to pay an 18 P/E multiple for 0% expected earnings growth.

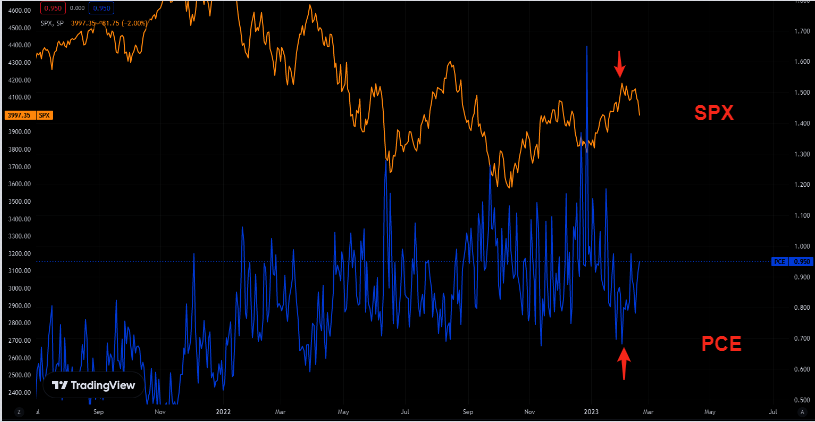

The chart below shows the SPX500 and the PCE (Put Call Ratio Equities). The SPX500 peaked. On the other hand, the PCE bottomed out at the same time.

They sold their put options while the SPX500 peeked. The crowd seems to hate put options when they should love them.

Premium subscription

Tired of seeing low-effort content on Twitter with random people posting lines on a chart?

Maybe subscribing to this newsletter is something for you to gain an edge over the market.

Read this content, and give your wife the impression that you actually know what you're reading instead of being a compulsive gambler using "Technical Analysis" (Astrology for men) only.

Also, read my free medium articles: https://medium.com/@romanornr/

Full access to exclusive premium content

Subscribe, and get a competitive edge over the market.

Take the first step to kick your wife's boyfriend out of the house & stop getting liquidated.

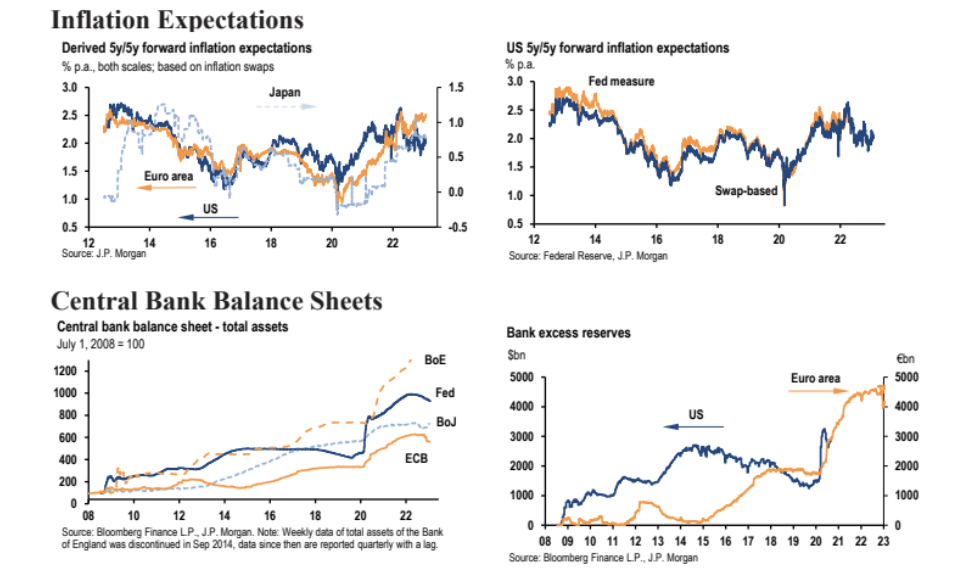

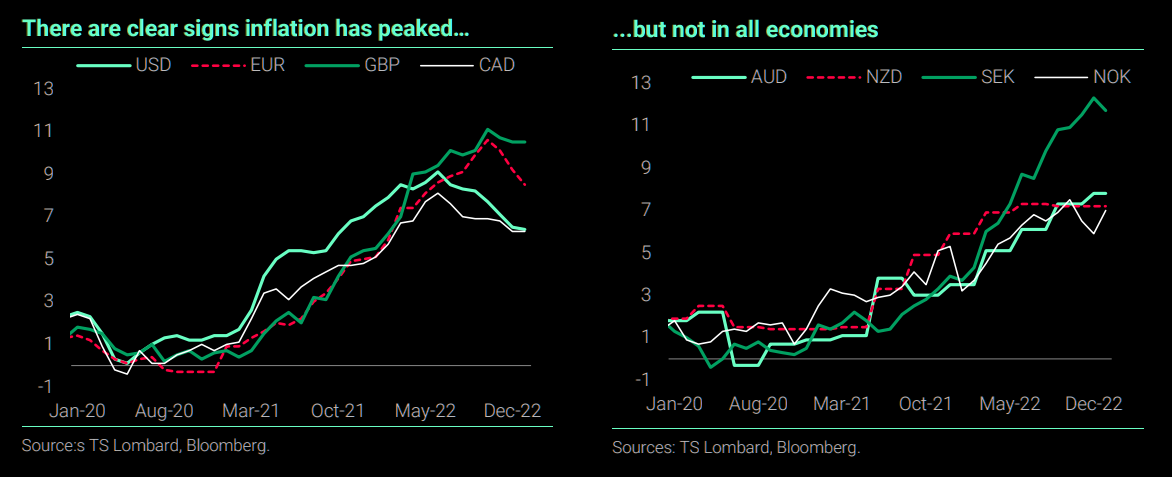

Stubborn inflation lingers in some economies

This graph from TS Lombard shows the trend of inflation worldwide with two distinct graphs (left and right)

The left side shows the US dollar (USD), euro (EUR), British pound (GBP), and Canadian dollar (CAD).

According to Lombard, there are clear signs that inflation in these four countries has peaked. The other side of the graph shows the Australian dollar (AUD), New Zealand dollar (NZD), Swedish krona (SEK), and Norwegian krone (NOK).

Lombard shows that in the corresponding economies, inflation has not peaked. He is pointing out that while inflation may have peaked in some of the larger economies, it remains stubbornly elevated in some of the smaller economies.

The global inflation problem is still very much a concern and could accelerate further. This means central banks must carefully balance price and economic/financial stability as they move forward.

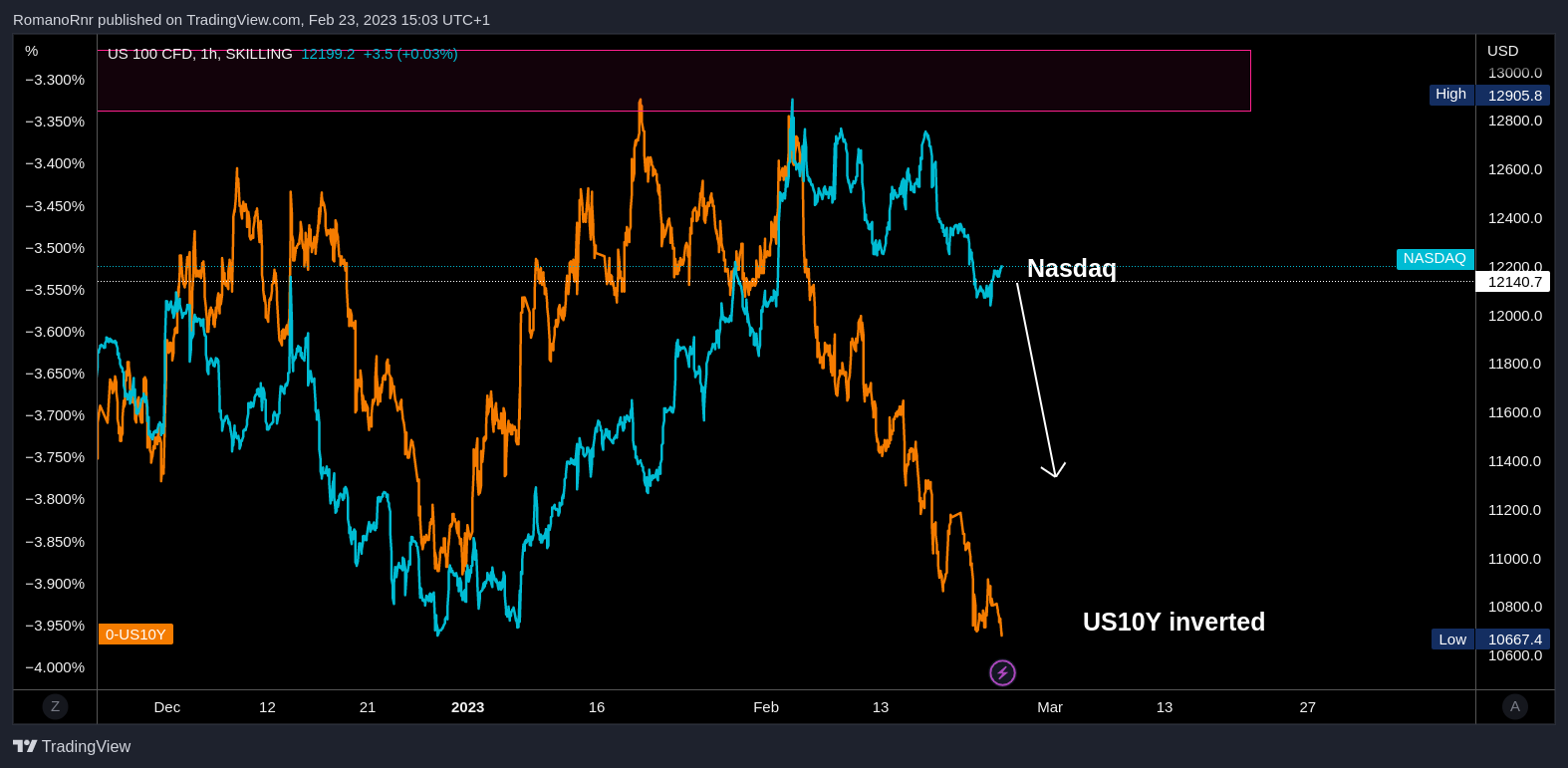

Nasdaq and US10Y

Nasdaq has increased faster than the 10-year real yield, indicating that tech stocks have been able to keep up with or outperform the 10-year yield.

The question is whether or not tech stocks will be able to catch up to the return of the 10-year.

Some dislocation and perhaps the Nasdaq will see a correction

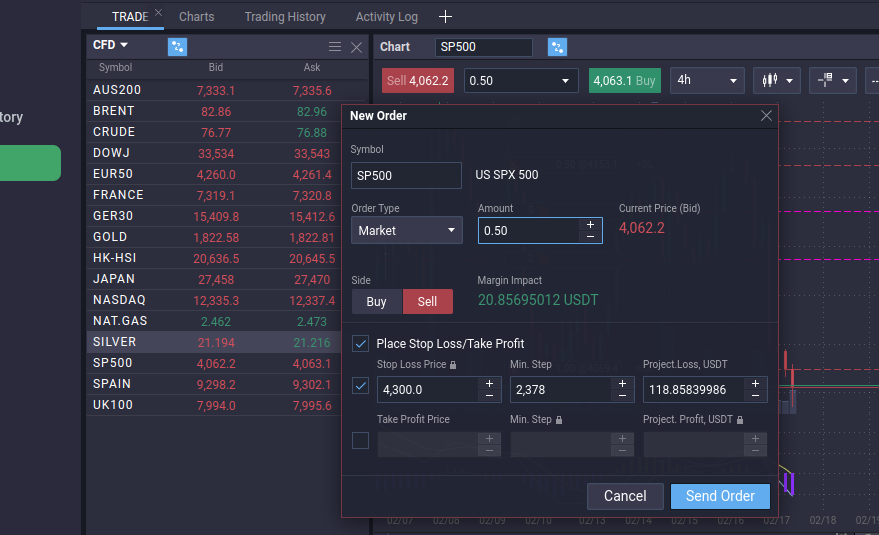

PrimeXBT (If you're looking to execute trades)

PrimeXBT is a crypto-based platform that enables traders to access multiple assets and markets, including cryptocurrencies, stocks, commodities, CFDs, and forex.

PrimeXBT is an online broker that allows traders to trade with leveraged trading, offering up to 1:1000.

With PrimeXBT, traders can open and close positions quickly.

The minimum deposit is about $10, and no KYC is required. PrimeXBT users can buy Bitcoin, USDT, and USDC using a credit card in the client dashboard.

I have been using PrimeXBT to test out, as I've been looking for a broker to trade the SPX500, Forex, and commodities.

Here is my advice, as I've been testing. I prefer not to use Bitcoin as my collateral but instead USDT or USDC.

As bitcoin can be volatile and correlated, your collateral can go down as bitcoin goes down, so risky business. That's why I prefer using stablecoins as collateral.

Make sure to fund either the USDT or USDC instead of margin BTC.

When you're using stablecoins as collateral, it's easier to place a stoploss and see how much you will be losing. This might be slightly off due to spread etc.

When having a position open, it looks like this.

I used multiple orders over a few days, and you can close each trade if you like by pressing the "x" button.

So if you've been following my newsletter for a while, you know I cover legacy markets, options, cryptocurrency, Forex, commodities, etc.

Many of you haven't been able to profit due to not having access to trading stocks/CFDs/commodities.

I suggest trying out PrimeXBT; I have heard about positive experiences with PrimeXBT from other traders.

My referral link for PrimeXBT: https://u.primexbt.com/rnr

Depending on the deposit amount, you can receive up to a $7000 bonus when registering with my referral link. Note that's the maximum bonus.

Promo code: rnr

I recommend creating an account and playing with $300 - $500 or an amount you don't care too much about just to practice first.

Don't take it too seriously, as you're just practicing. It's important to also look at legacy markets since everything is connected.

Premium subscription

Tired of seeing low-effort content on Twitter with random people posting lines on a chart?

Maybe subscribing to this newsletter is something for you to gain an edge over the market.

Read this content, and give your wife the impression that you actually know what you're reading instead of being a compulsive gambler using "Technical Analysis" (Astrology for men) only.

Also, read my free medium articles: https://medium.com/@romanornr/

Full access to exclusive premium content

Subscribe, and get a competitive edge over the market.

Take the first step to kick your wife's boyfriend out of the house & stop getting liquidated.

Gitcoin passport

it is important to possess an up-to-date Web 3.0 Passport for protection against Sybil attacks. Sybil attacks involve an attacker creating multiple accounts to increase their chances of gaining something.

To tackle this issue, teams have resorted to retroactively airdropping tokens, which can be expensive and inefficient. On-chain identity is one of the solutions that can be used to identify accounts with people more accurately, as opposed to bots.

Creating a Gitcoin Passport is a great way to be prepared for situations like when a project announces that only Gitcoin Passport holders will get access to something. Gitcoin is well-known within the Ethereum community, so ensuring your passport is up-to-date is vital before a project’s website is overwhelmed by too much traffic.

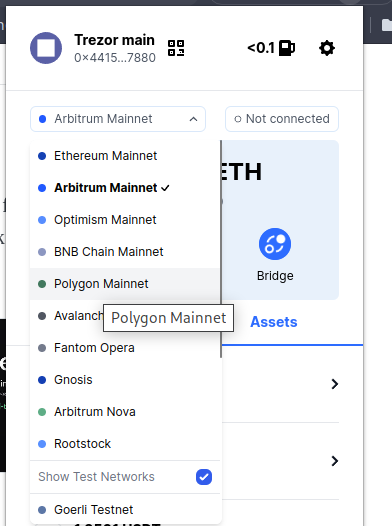

Blockwallet

I've been recommending Blockwallet in several tweets.

I made the switch from Metamask to Blockwallet.

The user interface and functions are much better; it works better with my Trezor and switching between accounts. Extra privacy, flash bot protection & anti-phishing. You can also import your Metamask seed, etc.

However, I've seen one of their latest tweets, BlockWallet has a token called "BLANK"

Kicking off the new year with some heat - the $BLANK token burn 🔥 pic.twitter.com/rm83xOo0wt

— BlockWallet 🔲 (@GetBlockWallet) January 16, 2023

If I were a betting man, which I am. I will assume that Blockwallet users are eligible for a nice airdrop. I would recommend installing Blockwallet and making some transactions.

You can export your Metamask seed and import it into Blockwallet. There's no need to reshuffle your assets etc., as some people think. Some people don't want to make the switch because Blockwallet has no mobile app right now. It doesn't matter. You can install Metamask or 1inch wallet on your phone and import your seed on your mobile wallet, which is not Blockwallet.

Chrome extension link: https://chrome.google.com/webstore/detail/blockwallet/bop

Gtrade

I've noticed this interesting DEX. So gTrade has a really nice UI but also has forex and stocks. I am still playing with the DEX. I recommend using the Polygon network to trade on the.

It's a decentralized alternative to PrimeXBT. The difference here is that you can trade decentralized using Polygon & Arbitrum.

There's no SPX500 to trade but you can trade SPY, also stocks such as Google, Tesla etc

Again, switching from network and bridging is easy with Blockwallet

There's still a contest ongoing, $100k in prizes for the Arbitrum trading contest.

Join the Gtrade Telegram group for fun and competition: https://t.me/GainsPriceChat

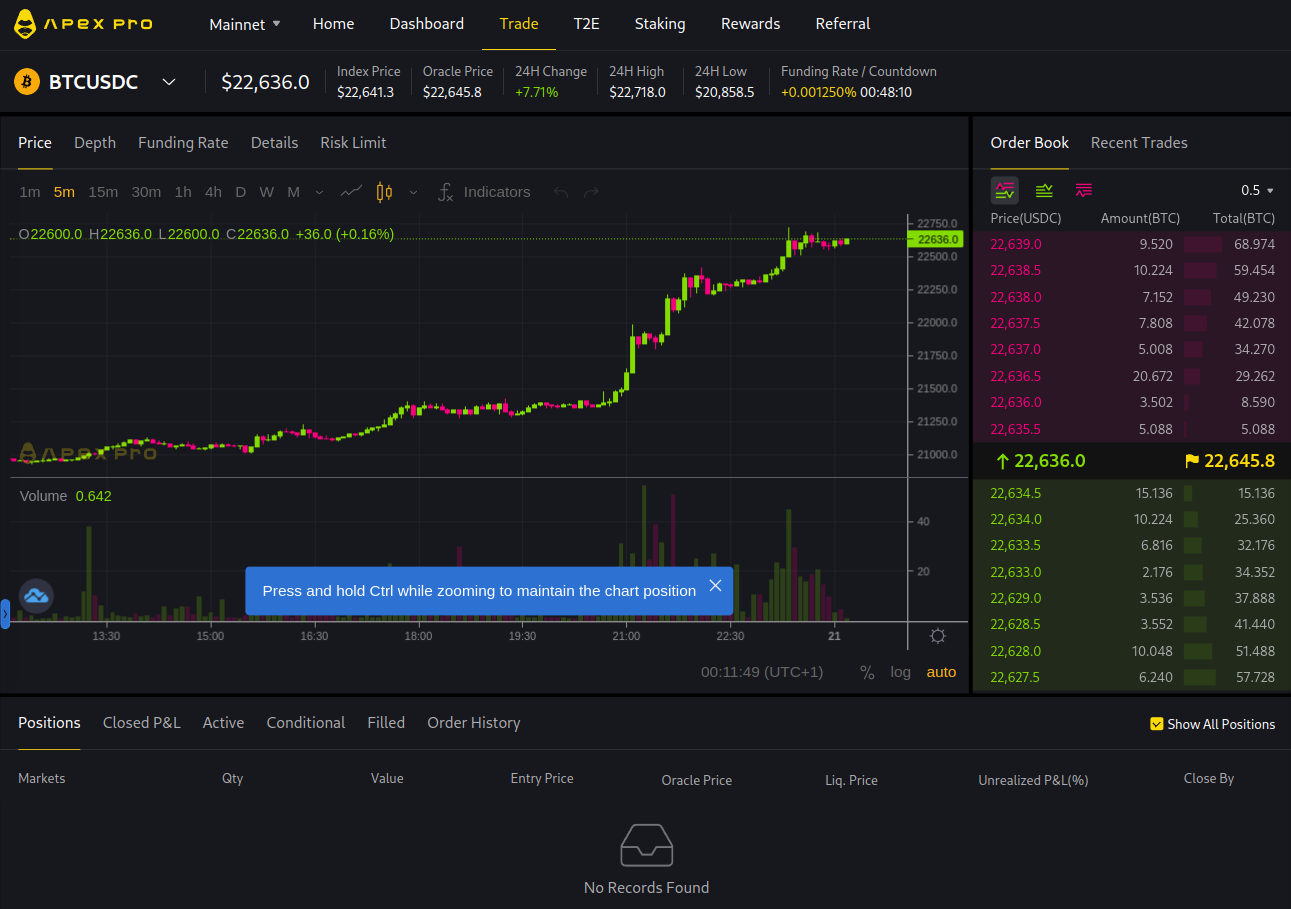

Apex Dex by ByBit

Reminder Apex incentive program, which pays you to trade and keep tour trade open, is ongoing.

They pay rewards to keep that position open lmao

— Romano (@RNR_0) January 12, 2023

Grand idea (however, maybe it won't work)

Use 1 wallet to long x amount

Use 1 wallet to short same amount

Farm rewards neutral?

Discount ref link code: https://t.co/JsJlHH5k3s

Ref code = 46

disclaimer: I hold 1 ApeX OG NFT pic.twitter.com/SgtbrREWS6

Think I can close it for a moment now

— Romano (@RNR_0) January 16, 2023

I like trading on Apex. I get rewards in BANA tokens as a reward

Basically, 1/3 position size as a reward/incentive to trade@OfficialApeXdex is a DEX from ByBit

Interface identical

Can recommend trying out https://t.co/JsJlHH5RT0 pic.twitter.com/Le0Y0y8X9d

If you need a referral link: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

My referral code is: 46

In my opinion, this is the best DEX for trading bitcoin futures.

They also have a mobile app, Android:

Also, an app for iPhone

Ref code = 46

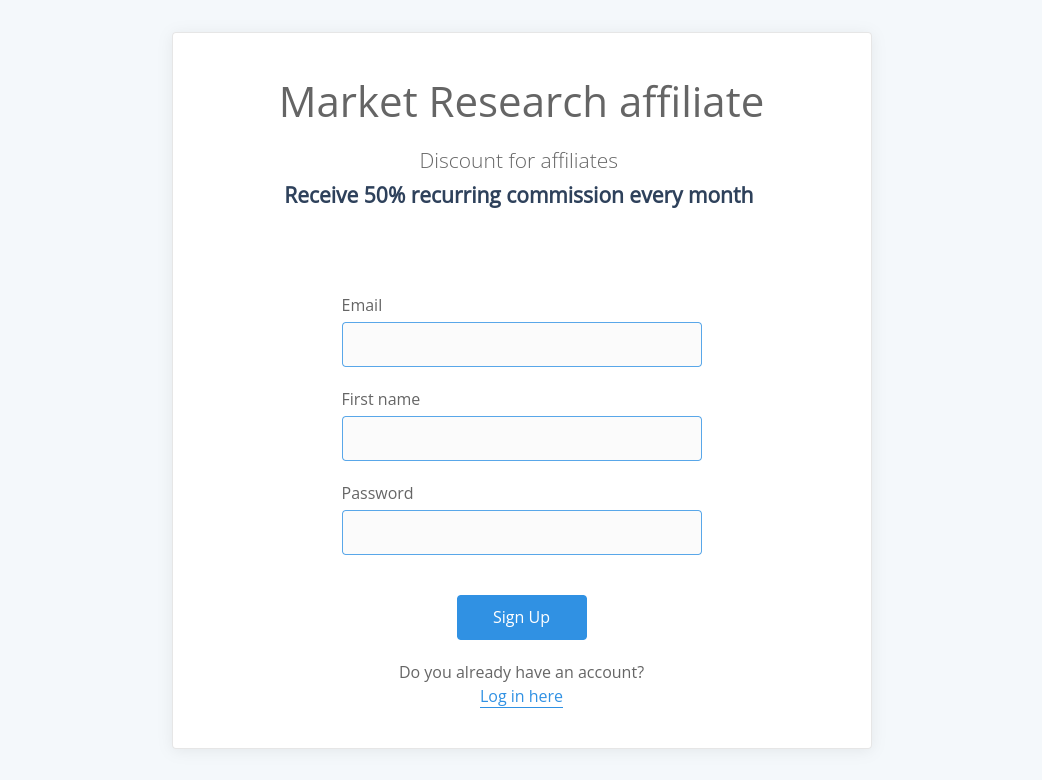

Become an affiliate of this newsletter.

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me, as compensation for promoting/sharing the newsletter with others.

Payouts can be in crypto or through a bank.

Newsletter affiliate

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me as compensation for promoting/sharing the newsletter with others.