FOMC - March 22 2023

Markets are on the edge of their seats, waiting to see what the Federal Open Market Committee (FOMC) will announce following their biggest meeting in many years.

The Federal Reserve will have to make a hard choice that might have big effect on the banking system.

In recent months, rapid rate rises have caused many small banks to lose a lot of money, which puts Fed Chairman Jerome Powell in a tough position.

Disclaimer: I am writing this in a rush; I've been programming for several hours with an IRL friend. I hope I finish this before the FOMC

Most experts, banks, and analysts think the Fed will raise rates by 25bps, but others have called for a pause, saying that doing so might be deflationary and slow down economic development. One outlier is even calling for a rate drop of 25 basis points, which is practically unheard of in the present situation. No matter what happens, the future of small banks remains uncertain.

I'm writing this in a rush, so on top of my head (Don't have the time to check, but I will try to use memory)

- Most banks & analysts think there will be a 25bps rate hike

- Goldman Sachs thinks there will be a pause. Barclays bank analysts changed their mind and thinks a 25bps rate hike or a pause but they lean towards a pause

- Nomura calls for a 25bps rate cut

This is it, will it be Jerome Powell Volcker's moment or not?

There's a lot at stake here. A lot at stake here, on god

The US housing data has calmed fears of an immediate recession while simultaneously heightening concerns that the Fed might continue raising interest rates, even in the face of tighter credit conditions.

Whatever the FOMC decides will have a huge impact. Let's go over the possibilities.

- If they don't raise rates, there will be a collective sigh of relief. On the other hand, the Federal Reserve loses its credibility (Not that they had much credibility, to begin with)

- If they do, it could cause panic & chaos in the markets

- If they raise by 25 basis points but stay hawkish and re-stack their dot plot, the reaction may be somewhat milder.

- Finally, if they hike by 25 bps and then turn dovish or announce they're done, then commodities and risk assets may rally, though unless a credit crunch is coming, inflation could remain an issue. It's a tense time for everyone, so we can only wait and see what happens.

(I really hope I can push this on time)

Crucial Moment as Russia and China Strengthen Their Alliance

This week, the Federal Open Market Committee (FOMC) meets to talk about the US economy in a very important way.

At the same time, Chinese President Xi Jinping and Russian President Vladimir Putin have recently agreed to strongly support each other in safeguarding each other's core interests. This might greatly affect the US currency, which Treasury Secretary Yellen said must be preserved.

Russian and China seem to have agreed to a peace plan, Putin has been invited to Beijing, and they have said they would work together. Putin's suggestion that Russian commerce with Emerging Markets and China be settled in the Chinese yuan might imply that the US dollar's function as the world's reserve currency would be questioned.

The FOMC will have to think carefully about this new situation and the continuing trade-off between inflation and financial stability to make sure that whatever judgments they make will be good ones. What the FOMC does might greatly affect the US currency and our economy. It will be a very important time for the nation and its standing in the world economy.

Please read my medium article I wrote in January: "G7 of the east"

I AM COMING BACK TO ALL OF THIS LATER IN A FUTURE ARTICLE. I DON'T HAVE MUCH TIME TO GO OVER THE DETAILS

Why Goldman Sachs thinks there will be a pause

Goldman Sachs thinks that even while the Fed is acting aggressively, the markets are still not sure whether attempts to help small and medium-sized banks would be enough to stop further stress in the banking system.

This post is a small post that is publicly for free. Usually, posts are for premium subscription members only.

Also, let me know if there's any preference in shorter articles that will be released more rapidly or longer 30min read newsletters.

UBS acquires Credit Suisse at a discount in a

Low net interest margins due to low-interest rates, high loan losses due to COVID-related defaults, lower fee income due to lower consumer spending, higher regulatory costs due to increased scrutiny, and limited access to capital markets due to risk aversion are just a few of the problems that small and medium-sized banks are currently dealing with.

Goldman Sachs thinks that stress in the banking sector is a bigger danger to economic recovery and financial stability than inflation or overheating. They thus anticipate that Fed policymakers would agree with them that it would be smart to pause at this meeting and wait for additional proof that bank lending conditions have improved before making any adjustments to monetary policy.

Implications of the pause

It shows that the Fed is careful about pulling back on monetary assistance too soon or too quickly because nobody knows how well banks will be able to deal with continued problems.

It means that the markets may have underestimated how aggressive or hawkish the Fed would be in the near future regarding increasing interest rates or cutting down on asset purchases.

Despite recent spikes in headline inflation brought on by transient variables like supply shocks or base effects, it shows that inflation expectations may stay anchored around the Fed's 2% target.

happen.

ByBit Deposit blast-off up to $30k

Sign up to Bybit with my referral link: https://partner.bybit.com/b/PA0ON66G6776

NFT airdrop

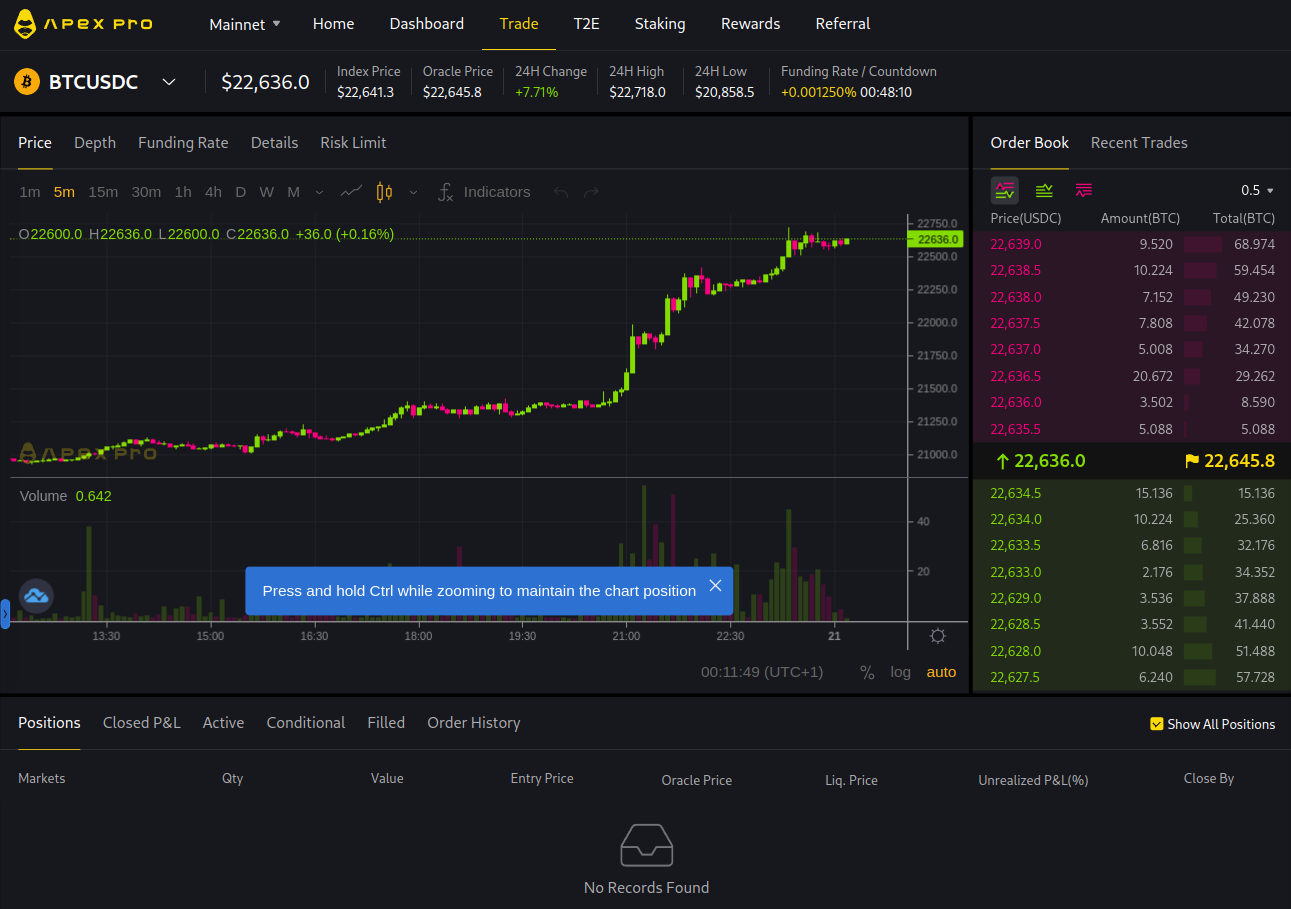

Apex Dex by ByBit

Reminder Apex incentive program, which pays you to trade and keep tour trade open, is ongoing.

They pay rewards to keep that position open lmao

— Romano (@RNR_0) January 12, 2023

Grand idea (however, maybe it won't work)

Use 1 wallet to long x amount

Use 1 wallet to short same amount

Farm rewards neutral?

Discount ref link code: https://t.co/JsJlHH5k3s

Ref code = 46

disclaimer: I hold 1 ApeX OG NFT pic.twitter.com/SgtbrREWS6

Think I can close it for a moment now

— Romano (@RNR_0) January 16, 2023

I like trading on Apex. I get rewards in BANA tokens as a reward

Basically, 1/3 position size as a reward/incentive to trade@OfficialApeXdex is a DEX from ByBit

Interface identical

Can recommend trying out https://t.co/JsJlHH5RT0 pic.twitter.com/Le0Y0y8X9d

If you need a referral link: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

My referral code is: 46

In my opinion, this is the best DEX for trading bitcoin futures.

They also have a mobile app, Android:

Also, an app for iPhone

Ref code = 46